-

2026-02-21 22:11

2026-02-21 22:11

By Faramarz Kouhpayeh

Trump risking US lives and economy to fight a war for Israel

The president’s push for a war against Iran serves Israeli interests, not American voters, and not even himself

TEHRAN - When Donald Trump was vying for a second term in the White House in 2024, he rolled out a series of promises to American voters. He said he would "end inflation," "make America affordable again," and create millions of jobs. He also pledged to "stop all wars" and become a "president of peace."

-

Behind Huckabee’s remarks: The U.S. role in advancing the ‘Greater Israel’ vision

TEHRAN – When US Ambassador to Israel Mike Huckabee told conservative commentator Tucker Carlson that it would be “fine” if Israel took all the Middle East land—from the Nile in Egypt to the Euphrates in Iraq—he revealed more than personal opinion.

-

By Sondoss Al Asaad

Blood in the Bekaa and Ain al-Hilweh: Who protects Lebanon’s sovereignty?

SOUTH LEBANON — The Israeli enemy has escalated its aggression against Lebanon, committing a massacre in the Bekaa Valley and launching a deadly strike on the Ain al-Hilweh refugee camp near Sidon.

-

By Wesam Bahrani

Trump’s “Board of Peace” sparks UN fears

TEHRAN – Concerns are mounting that U.S. President Donald Trump’s new initiative for Gaza could sideline the United Nations and reshape global governance.

-

Iran FM asks for evidence as West repeats casualty lies to justify future aggression

TEHRAN – Iran’s Foreign Minister Abbas Araghchi has asked Western officials and Western media to stop lying about the number of deaths during the recent unrest in the country—unrest that began with legitimate economic protests in late December but was infiltrated in January by armed Mossad and CIA agents who laid waste to Iranian cities and killed security forces and civilians alike.

-

Tehran condemns yet another Israeli aggression against Lebanon

TEHRAN - Iranian Foreign Ministry spokesman has categorically condemned recent Israeli attacks on Lebanon, namely the strikes on the Bekaa region and the Palestinian refugee camp of Ain al-Hilweh in Sidon, which left more than 40 Lebanese and Palestinians dead or wounded.

Politics

-

Iran’s warships become mobile air defense hubs with new missiles

TEHRAN - Newly released photos from last week’s IRGC Navy drill in the Strait of Hormuz show a new leap in Iran’s maritime power. During the “Smart Control” exercise, forces fired a Sayyad 3-G missile from the Shahid Sayyad Shirazi warship, a launch that showed Iranian vessels have officially moved past point defense and are now armed with long-range, vertical-launch capabilities.

-

The Western idea that change can be imposed from outside the Islamic Republic of Iran is an illusion

The New York Post recently claimed that the United States could dismantle Iran’s power structure using a Venezuela-style model and even suggested a figure in exile as a transitional option. The Post’s piece does not read like political analysis; it reads like a performance staged in a Washington think tank, detached from political and historical realities.

-

Iran sends Dena destroyer to MILAN-2026 exercise in the Indian Ocean

TEHRAN – In line with marine diplomacy, expanding defense interactions, and demonstrating operational capabilities in open seas, the Iranian Navy has sent its Dena destroyer to the Indian Ocean to participate in the “MILAN 2026” naval exercises hosted by India.

Sports

-

Persepolis suffer third successive defeat at 2025/26 PGPL

TEHRAN – Persepolis football team suffered their third successive defeat in the 2025/26 Persian Gulf Pro League (PGPL) after a 2-1 loss to Kheybar Khorramabad on Friday in Tehran.

-

Sohrab Bakhtiarizadeh shortlisted to lead Esteghlal

TEHRAN - Sohrab Bakhtiarizadeh has emerged as a leading candidate to replace Ricardo Sá Pinto at Esteghlal, as the club weighs their options for the future.

-

Shock exit: Esteghlal part ways with Sa Pinto

TEHRAN - Esteghlal have parted company with Portuguese coach Ricardo Sa Pinto in a surprise move, despite previously announcing plans to continue their cooperation.

Culture

-

33rd International Holy Quran Exhibition opens in Tehran

TEHRAN- The 33rd edition of the International Holy Quran Exhibition was inaugurated on Saturday, marking the commencement of a 15-day cultural event under the motto “Iran under the Protection of the Quran.”

-

Arasbaran Cultural Center reviews “Marty Supreme”

TEHRAN- “Marty Supreme”, a 2025 movie by American filmmaker Josh Safdie, went on screen at the Arasbaran Cultural Center in Tehran on Sunday.

-

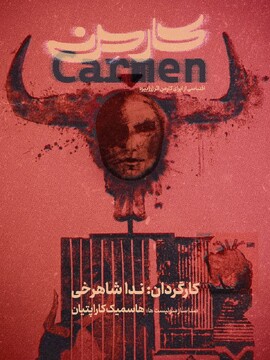

Art Palace hosting Georges Bizet’s opera “Carmen”

TEHRAN – Art Palace in Tehran is hosting an adaptation of “Carmen,” an opera in four acts by the French composer Georges Bizet.

Economy

-

Sanctions forge new path: Iran, Russia pivot to strategic energy alliance

TEHRAN- The Vice Chairman of the Iranian Parliament's Energy Committee, pointing to the development of oil fields and technology transfer between Iran and Russia, stated: "Investment by Russian companies in Iran's upstream projects, especially in gas and oil fields, in addition to providing financing, makes it possible to benefit from technical experience under sanctions."

-

South Pars to begin new year overhauls early, aiming for record efficiency

TEHRAN- The managing director of the South Pars Gas Complex announced that the major overhauls in the South Pars for the Iranian year 1405 (starts on March 21) will commence in the early days of the new year, stating that these operations will be carried out with an innovative approach, leveraging successful past experiences, and operational cohesion to increase equipment readiness and achieve record performance in the field of overhauls.

-

Maritime container production line to be launched soon with private sector co-op

TEHRAN- According to the head of the Industrial Development and Renovation Organization of Iran (IDRO), a production line for maritime containers is set to be launched soon with the cooperation of private sector.

Society

-

Ramadan offers great opportunity to raise awareness on environmental protection

TEHRAN – Highlighting the need to strengthen self-improvement, increase social responsibility and contentment, the fasting month of Ramadan provides a great opportunity to raise public awareness, build a more sustainable culture, and take effective steps towards environmental protection.

-

Education ministry launches national program for energy management

TEHRAN – The ministry of education has launched a national program aimed at preparing the next generation for improving water and energy consumption management and protecting national resources toward the country’s sustainable development goals.

-

Participants in scientific Olympiads up 40% year/year

TEHRAN – The number of students participating in Olympiad competitions has increased from 87,000 in the past Iranian year 1403 (March 2024- March 2025) to 121,000 this year, indicating an increase of 40 percent, the head of Young Scholars Club has said.

Tourism

-

Excavation begins to identify cause of drying at Cheshmeh-Ali in Rey

TEHRAN – Excavation operations have begun at the historical Cheshmeh-Ali spring in Rey, southern Tehran, to identify the source of its water and examine the condition of its water bed in a bid to determine the causes of its drying and propose revival measures, a local cultural heritage official said.

-

Mazandaran exports 4,500 handicraft items to Uzbekistan and Germany

TEHRAN – Mazandaran province exported 4,500 handicraft items to Uzbekistan and Germany, a provincial official said on Saturday.

-

South Khorasan embroidery, a story from tree of life to auspicious knots

TEHRAN—A kind of traditional embroidery known as Chekan-duzi in the city of Seh Qaleh in South Khorasan province, has been telling the story of life, beliefs, and tastes of the desert people for more than 150 years with symbolic patterns such as the ‘tree of life’ and auspicious knots.

International

-

Behind Huckabee’s remarks: The U.S. role in advancing the ‘Greater Israel’ vision

TEHRAN – When US Ambassador to Israel Mike Huckabee told conservative commentator Tucker Carlson that it would be “fine” if Israel took all the Middle East land—from the Nile in Egypt to the Euphrates in Iraq—he revealed more than personal opinion.

-

Blood in the Bekaa and Ain al-Hilweh: Who protects Lebanon’s sovereignty?

SOUTH LEBANON — The Israeli enemy has escalated its aggression against Lebanon, committing a massacre in the Bekaa Valley and launching a deadly strike on the Ain al-Hilweh refugee camp near Sidon.

-

Trump’s “Board of Peace” sparks UN fears

TEHRAN – Concerns are mounting that U.S. President Donald Trump’s new initiative for Gaza could sideline the United Nations and reshape global governance.

Most Viewed

-

A war US could start—but not control

-

Iran exists today because of its missiles, says former UN weapons inspector

-

Iran’s missiles ensure survival — Scott Ritter on why the Islamic Republic stands strong

-

Iran will answer respect with respect, and force with force, Araghchi tells US media

-

Iran’s warships become mobile air defense hubs with new missiles

-

Trump risking US lives and economy to fight a war for Israel

-

The Western idea that change can be imposed from outside the Islamic Republic of Iran is an illusion

-

Iran and Egypt to promote diplomatic ties to level of ambassador

-

Saudi Arabia to replace Israel with Syria in fibre-optic project, report says

-

Iranian fighter jet crashes, pilot killed

-

Governance in the rubble: Why Hamas still holds Gaza

-

Prince Andrew's Epstein arrest: A nightmare the British monarchy can't escape

-

Here’s how Iran sees the US

-

Trump directs release of ‘highly complex’ files on ‘alien life’

-

Iran sends Dena destroyer to MILAN-2026 exercise in the Indian Ocean