-

2026-03-01 08:26

2026-03-01 08:26

Leader of the Islamic Revolution Ayatollah Seyyed Ali Khamenei martyred in his office

TEHRAN - The Leader of the Islamic Revolution, Ayatollah Seyyed Ali Khamenei, was martyred during U.S.-Israeli airstrikes that targeted his office in central Tehran on Saturday.

-

Iran pounds Israel, keeps up attacks on regional U.S. bases overnight

TEHRAN - Iranian Armed Forces seemed to pour more focus into pummeling Israeli sites in the occupied territories on Saturday night and in the early hours of Sunday, but also continued to target U.S. and Israeli assets across the Persian Gulf, and expanded its operation to include the Indian Ocean.

-

IRGC says 'successive slaps' against US and Israeli assets in the region will continue

TEHRAN – In a statement published Sunday morning, the Islamic Revolution Guard Corps (IRGC) announced that Iran's Armed Forces will continue to pummel U.S. bases in the region, as well as the occupied territories, maintaining attacks on these assets since first coming under assault Saturday morning.

-

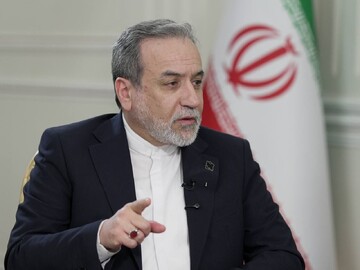

Israel, US have ‘broken our heart, we will break their heart,’ Larijani says of Leader’s assassinat

TEHRAN – Following the assassination of the Leader of the Islamic Revolution Ayatollah Ali Khamenei in an Israeli-U.S. airstrike on his office on Saturday morning, a top Iranian security official told a televised program on Sunday morning that the United States and the Zionist Israeli regime have “broken the heart of the Iranians” and in response “we will break their heart”.

-

Iran’s Day 1 strikes

IRGC and Artesh hit 14 US bases, one ship, several Israeli cities, and begin closure of Hormuz Strait

TEHRAN – Iran launched a significant wave of missile and drone attacks against military installations across West Asia and targets within Israel throughout Saturday, beginning its offensive shortly after the United States and Israel conducted joint strikes against sites within Iran.

-

By Soheila Zarfam

Iran was not bluffing

Iranians warned renewed US aggression will trigger a regional war—and now It has

TEHRAN - When Iranian journalists sat down with diplomats ahead of the first round of the nuclear negotiations in early February, they all had one question in mind: Do we even know that the U.S. will not attack Iran in the middle of talks again?

Politics

-

Ten critical questions following the U.S.-Israeli military assault on Iran

TEHRAN – On Saturday, February 28, 2026, the Islamic Republic of Iran became the target of a coordinated wave of military aggression by the United States and Israel.

-

IRGC strongly hits USS MST vessel

TEHRAN – The IRGC Navy has strongly hit an American USS MST vessel, the public relations office of the IRGC announced late on Saturday.

-

Origin of any attack on Iran is a ‘legitimate target,’ Iran FM says

TEHRAN - Iranian Foreign Minister Abbas Araghchi, while insisting on the Islamic Republic’s formidable policy of good neighborliness and friendship with all regional countries, has warned against any participation in the acts of aggression against a neighboring country.

Sports

-

Iran likely to withdraw from 2026 FIFA World Cup

TEHRAN – FIFA will "monitor developments" in Iran following the outbreak of military action by the United States -- the co-hosts of this summer's men's World Cup -- against Iran, who have qualified for the tournament and is due to play their group games in the U.S.

-

Iran, South Korea to lock horns at AFC Women’s Asian Cup 2026

TEHRAN - The respective head coaches of Korea Republic and Iran expressed confidence in their tournament preparations ahead of their opening AFC Women’s Asian Cup Australia 2026 clash at the Gold Coast Stadium on Monday, which will represent the first-ever meeting between the pair.

-

Iranian women carry the hopes of a generation

TEHRAN - As the 2026 AFC Women’s Asian Cup unfolds in Australia from March 1–21, few stories are as inspiring and hard-earned as that of Iran’s women’s national football team. For only the second time in its history, Iran have qualified for this premier continental tournament, a milestone that reflects both sporting progress and social resilience.

Culture

-

“Sami” to compete in 2nd Sapienza Film Festival

TEHRAN – Iran’s first Arabic-language drama “Sami” written and directed by Habib Bavi Sajed will compete in the main competition section of the 2nd Sapienza Film Festival, set to be held from March 4 to 7, in Napoli, Italy.

-

Arasbaran Cultural Center to review “Nuremberg”

TEHRAN- “Nuremberg”, a 2025 movie by American film director and screenwriter James Vanderbilt, will be reviewed at the Arasbaran Cultural Center in Tehran on Sunday evening.

-

Tehran theater to host reading performance of Stoppard’s “A Separate Peace”

TEHRAN- Sahne-ye Abi Theater in Tehran will be playing host to a reading performance of British playwright and screenwriter Tom Stoppard’s “A Separate Peace: A Play in One Act” on Tuesday.

Economy

-

NIDC drills 116 oil, gas wells in 11 months, up 23% year-on-year

TEHRAN – National Iranian Drilling Company (NIDC) drilled and completed 116 oil and gas wells in the first 11 months of the current Iranian year (March 2025-February 2026), marking a 23 percent increase compared with the same period last year, a senior official at the company said.

-

Iran’s exports to Qatar rise 34%, trade balance turns positive

TEHRAN – Iran’s non-oil exports to Qatar rose 34 percent in weight and eight percent in value in the first 10 months of the current Iranian year (March 2025-January 2026), reaching $122 million, while lower imports shifted the bilateral trade balance into surplus in Iran’s favor.

-

Non-oil goods worth nearly $5b exported from Khuzestan in 10 months

TEHRAN- As announced by a provincial official, 17.029 million tons of non-oil commodities valued at $4.925 billion were exported from Khuzestan province, in the southwest Iran, during the first 10 months of the current Iranian calendar year (March 21, 2025-January 20, 2026).

Society

-

National energy management program implemented in 120,000 schools

TEHRAN – According to the ministry of education, the national program for energy management has been implemented in 120,000 schools so far.

-

Over 8,850 prisoners of involuntary crimes freed this year

TEHRAN – A total of 8,859 prisoners of unintentional crimes have been released from prison so far in the current Iranian year (which began on March 21, 2025).

-

Over 2,000 students attend Kid Code tech competition

TEHRAN – Some 2,180 students have participated in the fifth edition of the national scientific and technology competition known as Kid Code. This year, the competition was held on February 26 and 27 at Tehran Permanent International Fairgrounds, attracting students from 28 provinces of the country.

Tourism

-

Study sheds new light on UNESCO-listed Khorramabad Valley Prehistoric Sites

TEHRAN – A new scientific article on the Chalcolithic and Bronze Age periods in the Khorramabad Valley has been published in the latest issue of the journal of the National Museum of Iran, the head of Lorestan’s Cultural Heritage Department said on Friday.

-

National eco-lodge training workshops launched

TEHRAN – National training workshops for eco-lodge operators have begun across Iran, the head of the Iranian association for eco-lodge operators said on Saturday.

-

Bread wrapping; a motherly ritual during Ramadan

TEHRAN-- In the old alleys and traditional neighborhoods of Bushehr province, a motherly ritual called ‘noon pooshi’ (bread wrapping) is held with the arrival of Ramadan.

International

-

Ideology reshapes U.S. diplomacy in West Asia

TEHRAN – The United States’ diplomacy is under scrutiny after remarks by its ambassador to Israel signaled a clear ideological shift.

-

Why are the American people turning away from Israel?

TEHRAN – For decades, support for Israel functioned as a near-sacred pillar of American political life. It transcended party lines, survived wars and uprisings, and remained largely immune to shifts in public mood. That consensus is now visibly fracturing. The latest Gallup findings mark a historic inflection point: for the first time in a quarter century of polling, more Americans say they sympathize with Palestinians than with Israelis. The shift is not marginal; it is structural, generational, and political.

-

Pakistan carries out airstrikes inside Afghanistan with no letup in border fighting

Pakistan’s military, backed by artillery and air power, struck more military installations deep inside Afghanistan overnight and into early Saturday, after Pakistan said it was in “open war” with its eastern neighbor, the Associated Press reported.

Most Viewed

-

Iranian missiles hit five key US bases

-

85 female elementary students killed in US-Israeli strike on Iran

-

Iran was not bluffing

-

Iran’s Day 1 strikes

-

IRGC attacks Israel after US-Israeli strikes on Iran

-

Leader of the Islamic Revolution Ayatollah Seyyed Ali Khamenei martyred in his office

-

IRGC strongly hits USS MST vessel

-

Iran’s Foreign Ministry vows ‘decisive defense’ after US bombs negotiating table a second time

-

Ten critical questions following the U.S.-Israeli military assault on Iran

-

Iran pounds Israel, keeps up attacks on regional U.S. bases overnight

-

Global reactions erupt following U.S.-Israel strikes on Iran

-

Trump’s justification and the logic of war

-

All high-ranking Iranian officials are alive: FM

-

From headlines to hostilities: How Israel and US media beat the drums of war with Iran

-

IRGC says 'successive slaps' against US and Israeli assets in the region will continue