-

2025-09-07 23:09

2025-09-07 23:09

Leader welcomes Pezeshkian's visit to China:

Potentials for economic and political cooperation with China must be pursued

TEHRAN – Leader of the Islamic Revolution Ayatollah Seyyed Ali Khamenei told the Pezeshkian administration on Sunday that the government should not let the threat of a potential war with Israel or the United States derail its ongoing plans and their implementation.

-

By Mona Hojat Ansari

China's envoy to Iran addresses SCO summit, bilateral relations

TEHRAN – Chinese Ambassador to Iran, Cong Peiwu, hosted a press conference at his country’s embassy in northern Tehran on Sunday, inviting journalists from major Iranian and Chinese media outlets. For nearly two hours, he discussed the recent SCO summit, which he characterized as the bloc's largest gathering to date.

-

By Sondoss Al Asaad

How has the Lebanese Army saved Lebanon at a crucial moment?

BEIRUT — What happened in the Lebanese government session on Friday was a truce that could either be sustained or overturned. The Lebanese Army did not rebel against the political authority, but rather put an end to the abuse of political establishment in a bloody, destructive conflict.

-

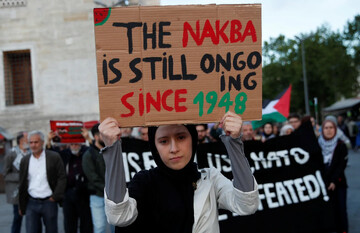

European cities erupt in solidarity with Gaza

Hundreds of demonstrations swept Europe this weekend as pro-Palestine activists staged a Global Day of Action demanding an immediate ceasefire, unfettered humanitarian access, and an end to what many called collective punishment in Gaza.

-

By Wesam Bahrani

Israeli tanks explode in Gaza

TEHRAN – The Palestinian resistance in Gaza wages more deadly operations against the Israeli Occupation Forces (IOF) attempting to invade Gaza City.

-

Europe’s ‘reckless course’ will only sideline it from future diplomacy: Araghchi

TEHRAN – Iranian Foreign Minister Abbas Araghchi has warned that Britain, France and Germany are jeopardizing their credibility and international standing by aligning with U.S. President Donald Trump’s strategy of maximum pressure on Tehran, urging the three to reconsider their approach before diplomacy is lost altogether.

Politics

-

Senior Iraqi cleric praises Iran’s success in war with Israel, calls for unity

TEHRAN – Seyed Ammar al-Hakim, leader of Iraq’s National Wisdom Movement (NWM), met with senior adviser to the Leader of the Islamic Revolution, Ali Akbar Velayati, in Tehran to discuss strengthening bilateral relations and regional cooperation.

-

Iranian athletes urge UN to demand release of academic detained by France

TEHRAN – A coalition of 165 Iranian women athletes has implored UN Secretary-General Antonio Guterres to intervene in the case of Mahdieh Esfandiari, an Iranian academic held in France. Detained since February for expressing solidarity with the people of Gaza, Esfandiari faces charges linked to social media posts.

-

Espionage network linked to Mossad, MKO faces trial in Iran

TEHRAN – The Court of Alborz Province has begun hearings for four individuals accused of espionage and collaboration with the terrorist Mojahedin-e-Khalq Organization (MKO) and the Israeli regime.

Sports

-

Piazza’s Iran prepare for global test

TEHRAN - As the 2025 FIVB Volleyball Men’s World Championship approaches, the Iranian national team are entering the tournament with a refreshed and somewhat restructured squad under the guidance of Italian head coach Roberto Piazza.

-

Iran’s Kiani makes history at 2025 World Wushu Championships

TEHRAN – Zahra Kiani made history by winning Iran’s first gold medal in women’s taolu at the 2025 World Wushu Championships.

-

Former Barca striker El Haddadi joins Esteghlal

TEHRAN – Esteghlal, one of the most prestigious clubs in Iranian football, has signed Spanish forward Munir El Haddadi.

Culture

-

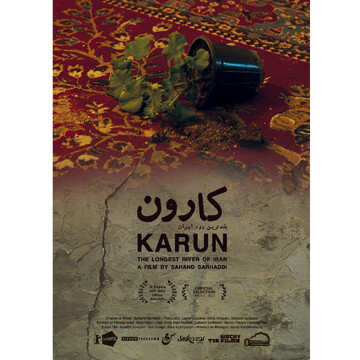

Short documentary “Karun – The Longest River of Iran” wins at Armenian festival

TEHRAN – The Iranian short documentary “Karun – The Longest River of Iran” written and directed by Sahand Sarhaddi won an award at the 11th Apricot Tree International Documentary Film Festival, which was held from August 30 to September 6 in Yerevan, Armenia.

-

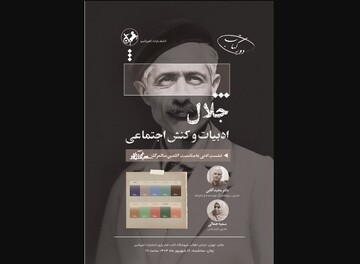

Tehran meeting to mark Jalal Al-e Ahmad’s legacy, social impact

TEHRAN- A literary forum titled "Jalal, Literature, and Social Engagement" is scheduled to be held at the Amir Kabir Publications Bookstore on Tuesday.

-

Arasbaran Cultural Center reviews “The Life of Chuck”

TEHRAN- “The Life of Chuck”, a 2024 fantasy movie by American filmmaker Mike Flanagan, went on screen at the Arasbaran Cultural Center in Tehran on Sunday.

Economy

-

Iran, Astrakhan officials push trade, transport ties under INSTC

TEHRAN – Iran’s consul general in Astrakhan Ahmad Heydarian, met with the governor of the Russian province to discuss trade, transport, and cultural cooperation.

-

TPO chief urges stronger trade, transport links within SCO

TEHRAN – Iran’s Trade Promotion Organization (TPO) head called for stronger economic and logistics cooperation among Shanghai Cooperation Organization (SCO) members, stressing the need to streamline customs procedures, standardize regulations, and improve transport infrastructure to ensure sustainable growth in the region.

-

Exports outpace imports in Iran-Kazakhstan trade

TEHRAN- Iran's Commercial Attaché in Kazakhstan, referring to the volume of trade between the two countries, reported an increase in exports compared to imports from Iran to Kazakhstan in the first three months of the current Iranian calendar year (March 21-June 21), as compared to the same period of time in the past year.

Society

-

Iran sends second, third aid shipments to Afghanistan

TEHRAN –The Iranian Red Crescent Society (IRCS) has dispatched the second and third humanitarian relief consignments to assist Afghan families affected by the recent devastating earthquakes.

-

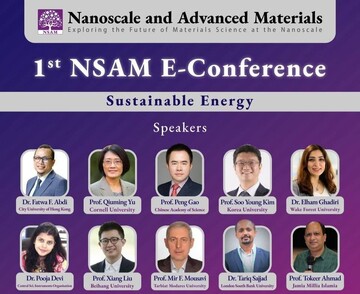

Nanoscale, Advanced Materials E-Conference on Sustainable Energy to be held

TEHRAN – Tehran will hold the first Nanoscale, Advanced Materials (NASM) E-Conference on Sustainable Energy on September 18.

-

Iranian team wins regional West Asia championship at ICPC 2025

TEHRAN – The students of Sharif University of Technology are placed atop West Asian countries at the 49th International Collegiate Programming Contest (ICPC) 2025.

Tourism

-

Iran pushes for UNESCO recognition of its ancient windmills

TEHRAN – Iran is seeking UNESCO World Heritage status for its centuries-old Asbads, traditional vertical-axis windmills primarily located in South Khorasan province, a senior official underlined on Saturday.

-

Iran enters a new level of ties with Armenia, tourism minister says

TEHRAN- Iran has reached a new level of leapfrogging relations with Armenia, said Minister of Cultural Heritage Seyyed Reza Salehi-Amiri.

-

Centuries-old coins bearing Prophet Muhammad’s name unveiled in Tehran ceremony

TEHRAN — A collection of 63 historical coins inscribed with the name of Prophet Muhammad (PBUH), ranging from the Abbasid era to the Qajar period, was unveiled for public view on Sunday.

International

-

Zionism is the problem: Ariel Feldman breaks down Israel’s Nakba and genocide

BUENOS AIRES — Ariel Feldman is an audiovisual filmmaker, lecturer in film and philosophy, and photographer who supports Palestine and denounces Israel’s colonial and genocidal policies. Drawing from his life experience in Israel and his Jewish identity, Feldman calls for ethical awareness in the face of the Israeli occupation and the suffering of the Palestinian people.

-

How has the Lebanese Army saved Lebanon at a crucial moment?

BEIRUT — What happened in the Lebanese government session on Friday was a truce that could either be sustained or overturned. The Lebanese Army did not rebel against the political authority, but rather put an end to the abuse of political establishment in a bloody, destructive conflict.

-

Israeli tanks explode in Gaza

TEHRAN – The Palestinian resistance in Gaza wages more deadly operations against the Israeli Occupation Forces (IOF) attempting to invade Gaza City.

Video Comment

-

Culture minister highlights year of progress in arts, global image enhancement

-

Gazan Journalists attacked by Israel

-

Brother of Iranian scientist murdered in Israeli strike speaks out

-

Footage shows Israel hit a kindergarten in Tehran

-

Delegates and ambassadors from 28 countries visited the IRIB building

Most Viewed

-

Iran to join other BRICS countries for naval drills in South African waters

-

Department of War: Trump reveals America’s true face

-

Potentials for economic and political cooperation with China must be pursued

-

How Trump’s ‘drug war’ masks his drive for war against Venezuela

-

Exclusive: Europe has become a ‘vassal’ of US in Iran policy, says Norwegian professor

-

Iran says calls from Japan and Australia for diplomacy ‘hypocritical’

-

Israeli tanks explode in Gaza

-

No clash with neighbors unless they plot against us, Iranians tell senior Iraqi cleric

-

China's envoy to Iran addresses SCO summit, bilateral relations

-

Western silence on Israel’s nuclear arsenal undermines non-proliferation: Araghchi

-

How has the Lebanese Army saved Lebanon at a crucial moment?

-

Exports from mining sector exceeds $4.1b in 4 months

-

Over 150 officials urge protection of Sumud humanitarian flotilla to Gaza

-

Iran, Japan discuss ways to cooperate on road, housing, urban development research

-

Historic Visit to China: A Launchpad for Iran’s Multilateral and Resilient Economy