-

2025-08-20 21:01

2025-08-20 21:01

By staff writer

What lessons can Europe learn from "daddy" school?

TEHRAN - US President Donald Trump’s recent meeting with European leaders appears to have left them with egg on their faces.

-

‘Turning point’ for Iran-Belarus relations as new cooperation roadmap planned

TEHRAN – Iranian President Masoud Pezeshkian said his visit to Belarus marked a “turning point” in bilateral relations, stressing that Tehran sees no limits to strengthening cooperation with Minsk across political, economic, and cultural fields.

-

US pursuit of ‘zero enrichment’ derailed nuclear diplomacy: Araghchi

TEHRAN – Iran’s top diplomat has stated that Washington’s recent military actions against Iran were a direct result of its failed efforts to force Tehran into completely abandoning its nuclear enrichment program.

-

By Sondoss Al Asaad

Saudi media keep inciting sectarian strife in Lebanon!

BEIRUT — There is a hadith that say, “Sedition is dormant, may God curse those who awaken it.” However, Saudi media has recently missed no opportunity to incite public feelings against the Shiites, reflecting the official Saudi position which aligns with American-Zionist pressure to disarm the Resistance, the common name for Hezbollah.

-

By Sahar Dadjoo

Exclusive: American filmmaker exposes Israel’s war on Palestinian journalists

Robert Greenwald says wearing press vests in Gaza does not protest journalists but make them targets

TEHRAN - In an exclusive interview with the Tehran Times, American filmmaker Robert Greenwald sheds light on the untold stories of Palestinian journalists who have been systematically silenced during Israel’s ongoing war on Gaza.

-

By Mona Hojat Ansari

Iran launches major naval drills, drawing on lessons from Israel war

TEHRAN – Iran’s naval forces on Wednesday prepared to enter the operational phase of an extensive missile and drone drill, with the drill’s spokesman telling the Tehran Times that the exercises will draw on Iran’s combat and defense experiences from recent years, including the recent 12-day war with Israel.

Politics

-

The next Iran-Israel conflict could be a more intense ‘shadow war’

TEHRAN – In recent decades, the confrontation between Iran and Israel has evolved into a battleground of overt and covert hostilities—sometimes erupting into full-scale warfare, other times unfolding through discreet yet impactful operations.

-

Iran used its older generation of missiles during recent war with Israel, says defense minister

TEHRAN – Iran’s Minister of Defense and Armed Forces Logistics has declared that the country possesses advanced missile systems with significantly greater capabilities than those deployed during the recent 12-day war against Israel, cautioning that Tehran will not hesitate to use them in response to any new hostilities.

-

Ayatollah Khamenei offers condolences on passing of Iranian miniaturist Mahmoud Farshchian

TEHRAN – Leader of the Islamic Revolution Ayatollah Seyyed Ali Khamenei has offered his condolences on the passing of the celebrated master miniaturist Mahmoud Farshchian.

Sports

-

Iran start 2025 FIVB U21 World Championship on high

TEHRAN – Iran defeated Kazakhstan 3-1 (25-19, 21-25, 25-23, 25-17) in the 2025 FIVB Volleyball Men’s U21 World Championship on Thursday.

-

Japan defeat Iran at 2025 Asian Women’s Junior Handball Championship

TEHRAN – Japan defeated Iran 30-18 at the 18th AHF Asian Women’s Junior Handball Championship on Thursday.

-

PGPL week 1: Shocking upsets and strong starts set tone

TEHRAN - The first week of the Iran’s Persian Gulf Professional League (PGPL) unfolded with intense matches on Monday and Tuesday, delivering unexpected results and early signs of fierce competition in the 25th season.

Culture

-

Iranian film, juror to participate in DMZ International Documentary Film Festival in South Korea

TEHRAN – The documentary “Cutting Through Rocks,” directed by Iranian filmmakers Sara Khaki and Mohammadreza Eyni will compete in the 17th DMZ International Documentary Film Festival, set to be held from September 11 to 17 in Gyeonggi, South Korea, where Iranian film critic, screenwriter, and editor Pouya Aghelizadeh will serve as a juror as well.

-

Kafka's letters to his sister, parents published in Persian

TEHRAN – The Persian translation of the book “Letters to Ottla and the Family,” which is a collection of Franz Kafka's letters to his sister Ottla as well as some letters to his parents Julie and Hermann Kafka, has been released in the Iranian bookstores.

-

Iran mourns passing of Master Mahmoud Farshchian: legendary artist laid to rest

TEHRAN- On Monday, the funeral procession of Master Mahmoud Farshchian, the celebrated Iranian miniaturist and painter, was held in Isfahan, drawing a vast crowd of mourners from across Iran.

Economy

-

Belarus views industrial cooperation with Iran as promising

TEHRAN- Belarusian Industry Ministry places great importance on the development of mutually beneficial cooperation between Belarus and Iran, Belarusian Industry Minister and Co-chair of the Belarusian-Iranian Intergovernmental Commission on Economic Cooperation Andrei Kuznetsov told BelTA on the sidelines of the high-level talks between Belarus and Iran at the Palace of Independence in Minsk on August 20.

-

Iran, Armenia slash tariffs as trade pact deepens under Eurasia framework

TEHRAN – Iran’s Industry, Mining and Trade Minister said tariffs on 87 percent of goods traded between Iran and Armenia have been eliminated, as Tehran presses ahead with efforts to expand a preferential trade pact with the Eurasian Economic Union (EAEU).

-

IEA says Iran boosts oil output by 200,000 barrels a day in July

TEHRAN – Iran’s crude oil production rose by about 200,000 barrels per day (bpd) in July, according to the International Energy Agency (IEA), which reported the country’s output reached 3.27 million bpd.

Society

-

Comprehensive plan for combating SDSs approved

TEHRAN – The national specialized working group on sand and dust storms (SDSs), in cooperation with other governmental bodies, has approved a comprehensive plan to address SDSs, which will be used as a national reference document to enhance the country’s resilience against one of the most acute environmental threats.

-

Six Iranian universities in Shanghai ranking 2025

TEHRAN – Shanghai University ranking 2025 has placed six Iranian universities among the top 1,000 institutions worldwide, down from 9 in 2024.

-

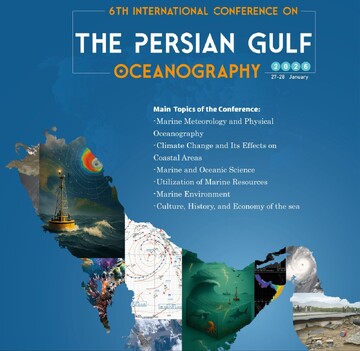

Intl. Conference on Persian Gulf oceanography slated for January

TEHRAN – The sixth international conference on the Persian Gulf oceanography is scheduled to be held on January 27 and 28, 2026.

Tourism

-

6,000-year-old fishing village reveals ancient maritime diet and fishing technology in Iran’s Makran

TEHRAN - Archaeologists working at the Koupal site in Dashtyari county, southeast Iran, have uncovered remarkable evidence of a 6,000-year-old fishing settlement, providing detailed insights into ancient maritime subsistence strategies.

-

Iran, Belarus agree to launch direct flights, ease visa rules

TEHRAN – Iran and Belarus have agreed to launch direct flights and expand tourism exchanges during President Masoud Pezeshkian’s visit to Minsk, Iran’s tourism minister said on Wednesday.

-

Opportunity available for 1m pilgrims to reside in holy city of Mashhad: deputy minister

TEHRAN—Deputy Tourism Minister Anoushirvan Mohseni Bandpei gave news of the possibility of providing accommodation for one million people in the holy city of Mashhad, Khorasan Razavi province, during the last days of the month of Safar, which coincides with the anniversary of the demise of Prophet Muhammad (PBUH), the martyrdom of Imam Hassan (AS), and the martyrdom of Imam Reza (AS).

International

-

What lessons can Europe learn from "daddy" school?

TEHRAN - US President Donald Trump’s recent meeting with European leaders appears to have left them with egg on their faces.

-

Saudi media keep inciting sectarian strife in Lebanon!

BEIRUT — There is a hadith that say, “Sedition is dormant, may God curse those who awaken it.” However, Saudi media has recently missed no opportunity to incite public feelings against the Shiites, reflecting the official Saudi position which aligns with American-Zionist pressure to disarm the Resistance, the common name for Hezbollah.

-

Israeli military vehicles blown up in Gaza

TEHRAN – Palestinian resistance forces have destroyed Israeli military vehicles in Gaza City, inflicting casualties among the occupation regime’s soldiers.

Most Viewed

-

Iran launches major naval drills, drawing on lessons from Israel war

-

Iran's military strength has increased since 12-day war: IRGC

-

Ukraine faces lose-lose choice

-

The next Iran-Israel conflict could be a more intense ‘shadow war’

-

What lessons can Europe learn from "daddy" school?

-

Iran, Armenia sign cooperation documents in different areas

-

Positions by Larijani, Qassem, and al-Houthi abort Washington’s threats to Lebanon

-

President Pezeshkian's Armenia visit: Cementing a strategic partnership

-

South Caucasus route takes center stage in Iran-Armenia talks as two sides plan strategic pact

-

Iran used its older generation of missiles during recent war with Israel, says defense minister

-

Sheila R. Canby, who shaped the study of Islamic art, dies at 76

-

Iran announces first domestic overhaul of BK-117 helicopter engine

-

Hamas accepts proposed deal for ceasefire

-

An unjustifiable coup

-

Economy minister outlines new financing plans to curb inflation, support production