-

2025-07-02 22:16

2025-07-02 22:16

By Garsha Vazirian

CIA and Mossad blinded

Pezeshkian signs bill requiring Iran to suspend cooperation with IAEA into law

TEHRAN – President Masoud Pezeshkian’s pen may have traced the contours of Iran’s break with an institution increasingly seen not as a guardian, but as a geopolitical saboteur—one with the blood of hundreds of Iranians on its hands.

-

Tehran says Germany spreading 'fake news', sending 'devastating messages'

FM Araghchi censures German's 'explicit' support for Israel attack on Iran's nuclear sites

TEHRAN – Iranian Foreign Minister Abbas Araghchi on Thursday dismissed as “fake news” a statement by the German Foreign Office that Tehran's move in suspending cooperation with the International Atomic Energy Agency “eliminates any possibility of international oversight of the Iranian nuclear program.”

-

By Kurosh Alyani, Iranian cultural critic

Culture, ethics, and martyrdom

Understanding Iran’s approach to war

TEHRAN – Talk of Iranian warfare often brings to mind the country’s long and rich history of conflict. From the campaigns of Cyrus the Great to the fierce resistance against invaders, Iran’s past is filled with stories of valor and combat.

-

Fordow nuclear site ‘seriously damaged’, declares Araghchi

TEHRAN – Iran’s Foreign Minister Seyyed Abbas Araghchi has stated that the recent U.S. airstrikes on the Fordow nuclear site have caused severe damage to the facility, though the full extent remains unclear.

-

By Mustafa Kamal

‘The enemy of my enemy is my friend’

A look at Egypt’s stance on the Israeli-Iranian confrontation

CARIO - Amid the recent military escalation between Israel and Iran, Egypt has adopted a balanced position reflecting its comprehensive strategic vision. Politically, Cairo condemned Israeli strikes on Iranian territory, warning that further escalation could plunge West asia into chaos, threatening regional security and stability.

-

IRGC spokesman says next war on Israel will be more ‘destructive’

TEHRAN – Brigadier General Ali Mohammad Naeini, the Islamic Revolution Guard Corps (IRGC) spokesman and deputy head of the Public Relations Department, says if Israel dares attack Iran again, it will receive a response far more “destructive” and “crushing” than previous military actions by Tehran.

Politics

-

Grossi could face trial in absentia for role in war against Iran

TEHRAN – A senior Iranian judiciary official has said that Rafael Grossi, Director General of the International Atomic Energy Agency (IAEA), could potentially face prosecution in absentia for his role in enabling recent U.S. and Israeli military aggression against Iran.

-

Israel lost on the battlefield — and also in the diplomatic arena

TEHRAN – Although the Iran-Israel war began in the early hours of Friday, June 13, with the Zionist regime’s blatant aggression against Tehran—an act any fair-minded observer would condemn—it nonetheless drew mixed reactions from world leaders.

-

IRGC reports operation against Israeli-linked sabotage elements in southeast Iran

TEHRAN – The Southeastern Regional Headquarters of the Islamic Revolution Guard Corps (IRGC) Ground Forces announced that 52 members of a terrorist network involved in acts of sabotage were either killed or apprehended during a recent security operation in Khash County, located in Iran’s southeastern Sistan and Baluchestan Province.

Sports

-

Iran discover fate at 2025 CAFA Nations Cup

TEHRAN – Iran national football team discovered their fate at the 2025 CAFA Nations Cup.

-

Iran squad for 2026 AFC Women’s Asian Cup qualification announced

TEHRAN – Iran’s women’s national football team head coach Marzieh Jafari has announced the 23-player squad for the upcoming 2026 AFC Women's Asian Cup qualification.

-

Iran’s fixtures at 2025 FIVB U19 and U21 World Championships revealed

TEHRAN – Iran’s match schedule for the 2025 FIVB Volleyball Men’s U19 and U21 World Championships has been announced.

Culture

-

Iranian filmmaker Kasra Tirsahar to serve on jury of Genesis International Film Festival

TEHRAN – Iranian film director and producer Kasra Tirsahar will serve as a juror at this year’s edition of Genesis International Film Festival (GIFF).

-

Iranian short film “Raana” wins at Social World Film Festival

TEHRAN – The Iranian short film “Raana” written and directed by Ahmad Monajemi won an award at the 15th Social World Film Festival, which was held from June 22 to 29 in Sorrento, Italy.

-

Jean Teulé’s “The Suicide Shop” to return to Homa Theater Hall

TEHRAN – The second round of the performance of “The Suicide Shop” directed by Hossein Nasiri will be staged at Homa Theater Hall in Tehran from July 8.

Economy

-

Government prepares supportive packages for war-damaged units’ return to production cycle

TEHRAN- Iranian minister of industry, mining and trade described the government's support for industries damaged by the enemy's invasion, in the form of the Ministry of Industry's production support plan, as an important step in returning damaged units to the production cycle.

-

Comprehensive support for shareholders on agenda of Supreme Council of Stock Exchange

TEHRAN- A member of the Supreme Council of the Stock Exchange said that the necessary measures are being taken to return stability to the market by utilizing all available capacities, adding, "Comprehensive support for shareholders has been placed on the agenda of the Supreme Council of the Stock Exchange."

-

Iran, China reach near $7b quarterly non-oil trade

TEHRAN - The value of non-oil trade between Iran and China stood at $6.939 billion during the first quarter of the current Iranian calendar year (March 21-June 21), according to the head of the Islamic Republic of Iran Customs Administration (IRICA).

Society

-

Experts discuss ways to strengthen national immunization program

TEHRAN – Participating in a consultative workshop, national experts and international partners explored the potential to promote the country’s immunization programmes.

-

Some 9,000 ha of forests devastated in Israeli assaults

TEHRAN –According to a report by the Department of Environment (DOE), around 9,000 hectares of forests and protected areas in the country have been set on fire and severely damaged during the attacks by the Zionist regime on June 13-24.

-

UN in Iran expects doubling of funding to meet emerging needs

TEHRAN – The UN resident coordinator in Iran, Stefan Priesner, has said Iran's aid budget will need to be increased, at least doubled, following the war imposed by Israel on the country.

Tourism

-

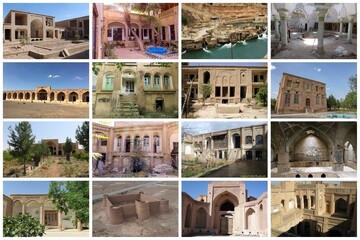

Iran seeks investors to revive 41 heritage sites in 16 provinces

TEHRAN – Iran’s revitalization fund for historical and cultural places has announced the launch of a major public auction aimed at attracting investors to restore, preserve, and make productive use of 41 historical sites located in 16 provinces across the country.

-

Qazvin’s threefold strategy for tourism highlighted during ministerial visit

TEHRAN - The Governor-General of Qazvin province, Mohammad Nozari, has emphasized a comprehensive three-pronged approach to advancing tourism in the province, encompassing short-, medium-, and long-term strategies.

-

Visit war machines on display at Tehran museum

TEHRAN - Museum of the Islamic Revolution and Sacred Defense in Tehran offers one of the most comprehensive war tourism experiences in West Asia, inviting visitors to witness a remarkable open-air exhibition of heavy military equipment used during the Iran–Iraq War (1980–88), known domestically as the “Sacred Defense.”

International

-

Israel intensifies concerns on the Lebanon-Syria border

BEIRUT — Day after day, concerns about potential threats to Lebanon’s eastern borders with Syria are growing. This is due to the failure of security and military meetings between the two countries to end recurring attacks on Lebanese villages by the HTS gangs.

-

Why do the Lebanese Forces want to amend electoral law?

BEIRUT — The anti–Resistance team, led by the Lebanese Forces party, failed on Monday to include in the urgent, duplicate draft law aimed at allowing expatriates to vote for the entire parliamentary seats, not just six seats (allocated for non-residents across the 6 continents, under the current parliamentary electoral law).

-

Over 100 leading global NGOs slam Gaza aid system

TEHRAN – Over 100 leading global NGOs fiercely denounce the Israeli occupation regime’s “deadly” and “militarized” aid delivery system in Gaza.

Most Viewed

-

CIA and Mossad blinded

-

Fordow nuclear site ‘seriously damaged’, declares Araghchi

-

IRGC spokesman says next war on Israel will be more ‘destructive’

-

Culture, ethics, and martyrdom

-

‘The enemy of my enemy is my friend’

-

Israel lost on the battlefield — and also in the diplomatic arena

-

Grossi could face trial in absentia for role in war against Iran

-

Iran facing more than NATO

-

Israel intensifies concerns on the Lebanon-Syria border

-

IRGC reports operation against Israeli-linked sabotage elements in southeast Iran

-

Iran, China reach near $7b quarterly non-oil trade

-

Tehran says Germany spreading 'fake news', sending 'devastating messages'

-

Top officials honor war victims in Tehran ceremony, vow no backdown against Israel

-

Government prepares supportive packages for war-damaged units’ return to production cycle

-

Israel is killing scientists and their families. The world is looking away