-

2026-02-18 23:15

2026-02-18 23:15

Iran-Russia cooperation expanding in all fields, including energy: Russian minister

By Mona Hojat Ansari

TEHRAN – Iran and Russia have steadily deepened their ties over the past decade, driven by geographic proximity, overlapping regional interests, and a shared sense of pressure from Western policies that threaten their national security and economic stability.

-

'Iran, Russia pledge to move beyond understanding to implementation'

TEHRAN- Iranian Oil Minister Mohsen Paknejad stated that what was ultimately agreed upon in the 19th meeting of Iran-Russia Joint Economic Committee represents the achievement of moving from understanding to the implementation phase.

-

Iran’s ‘inherent right’ to peaceful use of nuclear energy is non-negotiable: Araghchi

TEHRAN - Foreign Minister Abbas Araghchi reiterated on Tuesday that Iran as a signatory to the Nuclear Non-Proliferation Treaty (NPT) will not forego its right to nuclear technology for peaceful purposes, saying Tehran will not compromise on this right.

-

By Wesam Bahrani

Will Netanyahu resume genocidal war on Gaza?

TEHRAN – The Gaza Strip does not appear to be on the brink of a full-scale genocidal war anytime soon.

-

By Sondoss Al Asaad

The IMF trap: Balancing Lebanon’s budget on the backs of the poor

BEIRUT — On Monday, the Lebanese government approved a rise in the value-added tax (VAT) from 11% to 12% and imposed an additional 320,000 Lebanese lira levy on every gasoline canister.

-

Iran, Russia set to start naval drills in the Sea of Oman

TEHRAN – Iran and Russia will begin a joint naval drill in the northern Indian Ocean and the Sea of Oman on Thursday.

Politics

-

MPs voice support for Leader’s remarks

TEHRAN - Members of the Iranian Parliament have, in a statement, expressed their backing for recent comments by Leader of the Islamic Revolution Ayatollah Ali Khamenei by reaffirming their obedience to his instructions.

-

Pezeshkian sends congratulatory message to Japanese PM on National Day

TEHRAN - Iranian President Masoud Pezeshkian has sent a message to Japanese Prime Minister Sanae Takaichi, expressing congratulations to Japan on National Day.

-

Turkey reiterates concerns over consequences of a US war against Iran

TEHRAN -Turkish President Recep Tayyip Erdogan has reiterated his concern that a new U.S. war against Iran would destabilize the region.

Sports

-

Iran’s women’s football team announced for 2026 AFC Women’s Asian Cup

TEHRAN – Iran’s women’s football team head coach Marzieh Jafari has called up 25 players for the 2026 AFC Women’s Asian Cup.

-

Iran aim to create history at 2026 AFC Women’s Asian Cup: AFC

TEHRAN - Iran will be aiming to create more history when they compete against Asia’s elite at the AFC Women’s Asian Cup Australia 2026.

-

Hosseinzadeh hails Tractor after win over Al Gharafa

TEHRAN - Goalscorer Amirhossein Hosseinzadeh hailed Tractor’s top-notch performance after the Iran side concluded their AFC Champions League Elite 2025/26 league phase with a 2-0 win against Al Gharafa on Tuesday.

Culture

-

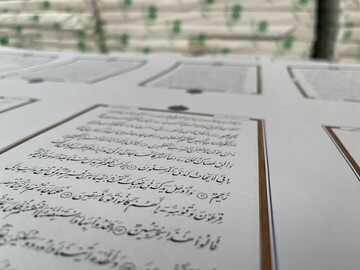

Exquisite handwritten Quran in Islamic world printed in Nastaliq script

TEHRAN – The first complete Holy Quran in Nastaliq script, following the style of Master Uthman Taha and approved by the Dar al-Quran Organization, has been published.

-

Russia’s cultural center inaugurated in Tehran

TEHRAN- The official inauguration ceremony of the Russia’s cultural center- Russian House- in Tehran was held on Tuesday morning, marking a new chapter in cultural diplomacy between the two countries.

-

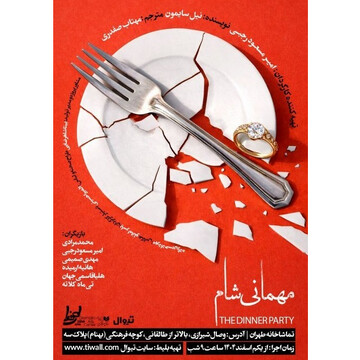

Neil Simon’s “The Dinner Party” to go on stage at Tehran Theater Complex

TEHRAN – The play “The Dinner Party,” a one-act comedy written by Neil Simon about marriage and divorce, will be performed at the Tehran Theater Complex from February 20.

Economy

-

'Iran, Russia pledge to move beyond understanding to implementation'

TEHRAN- Iranian Oil Minister Mohsen Paknejad stated that what was ultimately agreed upon in the 19th meeting of Iran-Russia Joint Economic Committee represents the achievement of moving from understanding to the implementation phase.

-

Trade between Iran, Qatar turns positive as exports rise 34% in 10 months

TEHRAN – Iran’s trade balance with Qatar swung into surplus in the first 10 months of the Iranian year 1404 (March 2025-January 2026), driven by a sharp rise in exports and a decline in imports, a senior trade official said.

-

Iran invites UAE investors to tap major economic projects

TEHRAN – Iran has invited Emirati investors to participate in major projects across its economy, the country’s economy minister said during a meeting with the United Arab Emirates’ new ambassador to Tehran.

Society

-

WHO representative stresses road safety as key to public health

TEHRAN – Awad Mataria, the acting World Health Organization (WHO) representative in Iran, has highlighted the critical role of road safety as one of the most urgent intersections of engineering and public health.

-

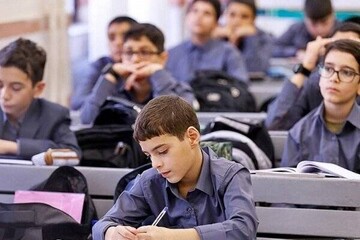

Some 30,000 out-of-school students resume education

TEHRAN – Nearly 30,000 out-of-school students have resumed education in the current academic year, which started on September 23, 2025, according to an official with the Ministry of Education.

-

Winners of national event on future schools honored

TEHRAN - The third national event on future schools was held on Tuesday, honoring eight top ideas from more than 200 received by the event’s secretariat.

Tourism

-

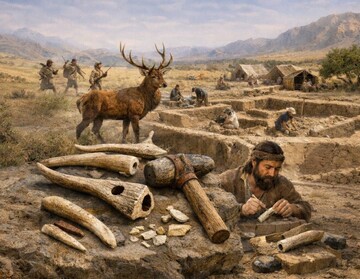

Iran’s Neolithic communities excelled in antler craft, research shows

TEHRAN - A recent archaeological study published in the journal Anthropozoologica sheds new light on the sophisticated craftsmanship and resource strategies of early human societies on the Iranian Plateau.

-

17th-century Chehel Sotoun Palace fully reopens to visitors

TEHRAN – All sections of Isfahan’s Chehel Sotoun Palace, including the room known as Chaharshanbeh Suri and the Stone Museum, have been reopened to the public, the site’s director said on Wednesday.

-

101 Shiraz-minted coins registered on national heritage list

TEHRAN – A collection of 101 coins minted in the southern city of Shiraz has been registered on Iran’s national list of movable cultural heritage, the Ministry of Cultural Heritage, Tourism and Handicrafts said.

International

-

Ramadan in Gaza: Palestinians' spirit unbroken despite all hardships

TEHRAN – Ramadan has arrived in Gaza, and as the first crescent moon appeared, people welcomed the holy month with the same devotion felt across the Muslim world. But in Gaza, Ramadan never comes quietly. It arrives under the long shadow of Israel’s occupation and the deep wounds left by years of blockade, bombardment, and displacement. It is a month of prayer and patience, but also a reminder of everything people have endured under Israeli control.

-

Will Netanyahu resume genocidal war on Gaza?

TEHRAN – The Gaza Strip does not appear to be on the brink of a full-scale genocidal war anytime soon.

-

The IMF trap: Balancing Lebanon’s budget on the backs of the poor

BEIRUT — On Monday, the Lebanese government approved a rise in the value-added tax (VAT) from 11% to 12% and imposed an additional 320,000 Lebanese lira levy on every gasoline canister.

Most Viewed

-

Iran, Russia set to start naval drills in the Sea of Oman

-

Pezeshkian sends congratulatory message to Japanese PM on National Day

-

Iran-Russia cooperation expanding in all fields, including energy: Russian minister

-

'Iran, Russia pledge to move beyond understanding to implementation'

-

Iran’s ‘inherent right’ to peaceful use of nuclear energy is non-negotiable: Araghchi

-

Turkey reiterates concerns over consequences of a US war against Iran

-

Iran invites UAE investors to tap major economic projects

-

How faulty cognitive maps paralyze US strategy towards Iran

-

MPs voice support for Leader’s remarks

-

Uruguay presents football shirts to Iran in gesture of sporting friendship

-

Will Netanyahu resume genocidal war on Gaza?

-

Ramadan in Gaza: Palestinians' spirit unbroken despite all hardships

-

In interview with Tehran Times, Russia reaffirms strategic energy ties with Iran

-

At least 10 foreign spy services fueled Iran’s January unrest, says intel. commander

-

The IMF trap: Balancing Lebanon’s budget on the backs of the poor