-

2026-01-30 21:03

2026-01-30 21:03

By Saleh Abidi Maleki

‘Iran as ready for diplomacy as it is for war’

In Ankara, Araghchi restates Tehran’s long-held position as neighbors call on Washington to halt escalation against Iran

TEHRAN – Iran’s foreign minister, Abbas Araghchi, arrived in the Turkish capital on Friday with a message for Washington that was as firm as it was measured: Tehran remains open to a diplomatic resolution regarding its nuclear program, but it will not negotiate under duress, nor will it hesitate to engage in total war if the United States miscalculates again.

-

U.S. seeks an Iran that is subservient, says Chinese expert

Hongda Fan warns U.S. and Israeli interference could reshape regional alliances and intensify security rivalries

TEHRAN-Amid renewed unrest in Iran and escalating rhetoric from Washington and Tel Aviv, questions are mounting over whether Western claims of supporting civil liberties mask deeper geopolitical objectives. To explore these dynamics, Tehran Times spoke with Professor Hongda Fan, Professor and director of the China-Middle East Center at Shaoxing University, China.

-

By staff writer

Israel’s admission of Gaza death toll shatters its own denial

TEHRAN — A quiet admission from a senior Israeli military official has opened a door Israel has tried to keep shut for two years. By acknowledging that around 71,000 people have been killed in Gaza, the official effectively confirmed what the Gaza Health Ministry has been reporting since the start of the war.

-

By Wesam Bahrani

Trump’s threats against Iraq could backfire

TEHRAN – The U.S. president’s aggressive rhetoric about Iraq’s political future may ultimately produce the opposite of its intended effect.

-

Iran to EU: IRGC is world’s premier anti-terror vanguard

FM Araghchi says Europe would be battling ISIS on its own streets without the IRGC

TEHRAN — The Islamic Republic of Iran has launched a sweeping diplomatic and political counter-offensive following the European Union’s decision to classify the Islamic Revolution Guard Corps (IRGC) as a terrorist organization.

-

Iran Army bolsters combat power with massive drone integration

TEHRAN — The Iranian Army (Artesh) has officially integrated 1,000 “strategic” drones into the combat organization of its four service branches.

Politics

-

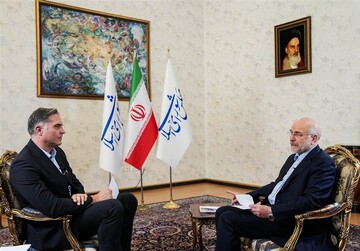

Qalibaf says Iran will pursue justice for terror riot victims at home and abroad

TEHRAN – Iran’s Parliament Speaker Mohammad-Baqer Qalibaf has reiterated that Tehran does not reject dialogue or diplomacy in principle, stressing that any negotiations must be genuine, balanced, and grounded in mutual respect, clear guarantees, and the protection of Iran’s national interests.

-

Tehran warns Berlin of consequences following Merz’s ‘low-minded provocations’

TEHRAN — The Iranian Foreign Ministry on Thursday summoned German Ambassador Axel Dittmann on Thursday to deliver a condemnation of Berlin’s increasingly aggressive interference in Iran’s internal affairs.

-

Iran’s response to any aggression will be ‘immediate, decisive:’ Pezeshkian warns

TEHRAN — Iranian President Masoud Pezeshkian has issued a stern warning against any military miscalculations by foreign powers, asserting that while the Islamic Republic seeks peace, it is fully prepared for a crushing retaliation.

Sports

-

Iran’s Gorgan lose to Astana: 2025/26 FIBA WASL

TEHRAN - BC Astana rose to solo no. 2 in the 2025/26 FIBA WASL-West Asia League standings following a vengeful 88-73 victory over Shahrdari Gorgan at the Sarkarya Velodrome on Friday night.

-

Iran defeat Saudi Arabia in 2026 AFC Futsal Asian Cup

TEHRAN - Iran survived a stern test to defeat Saudi Arabia 2-0 in their AFC Futsal Asian Cup Indonesia 2026 Group D tie on Friday.

-

Female taekwondo athlete Kiani sidelined for six weeks

TEHRAN – Iranian female taekwondo athlete Nahid Kiani underwent knee surgery on Thursday.

Culture

-

16th Ammar Popular Film Festival concludes in Tehran

TEHRAN – The 16th Ammar Popular Film Festival concluded on the evening of Thursday, January 29, in Tehran.

-

Iranian artist pens truth on Venezuela's front page

TEHRAN- An Iranian artist has articulated the nation's perspective on recent developments through the platform of a major Venezuelan publication.

-

Book exhibition at Kanoon displaying 300 titles by Iranian expats

TEHRAN – A book exhibition titled “Tak Khal” (literally meaning Ace), featuring 300 published works by Iranian expats in various languages, is underway at the Reference Library of the Institute for the Intellectual Development of Children and Young Adults (Kanoon), in Tehran.

Economy

-

Iran’s non-oil trade tops $94b in 10 months

TEHRAN – Iran’s total non-oil trade reached $94.123 billion in the first 10 months of the current Iranian calendar year (March 21, 2025-January 20, 2026), the Islamic Republic of Iran Customs Administration (IRICA) said.

-

Private sector seen doubling exports to Eurasian markets

TEHRAN – Iran’s private sector and traders have the capacity to double exports to some member states of the Eurasian Economic Union, a senior trade official said.

-

New Iranian vessel to be unveiled in Caspian Sea, co-op with Russia planned in 200 petchem projects

TEHRAN – Iran will unveil a new vessel in the Caspian Sea next week as part of efforts to expand cargo transport capacity, particularly container shipping, Iran’s ambassador to Russia said.

Society

-

Officials discuss promoting knowledge-based products in food, medicine sectors

TEHRAN – The headquarters for developing food and agricultural knowledge-based economy and the headquarters for developing traditional medicine and medicinal herbs have discussed ways to expedite the commercialization of knowledge-based products.

-

Iranian scholars win COMSTECH award 2025

TEHRAN –Two Iranian scholars have won Life-time Contribution Award of the Organization of Islamic Cooperation’s Committee on Scientific and Technological Cooperation (OIC-COMSTECH) in Biology and Chemistry for their outstanding achievements in science and technology.

-

A miracle for a migratory bird: Steppe Eagle from Kazakhstan released after being treated in Iran

TEHRAN – A migratory Steppe eagle from Kazakhstan that had lost its strength due to parasitic and skin diseases was released into the wild after receiving complete treatment at the provincial Department of Environment (DOE) in Izeh, a city in the south-western province of Khuzestan, and regaining the ability to fly.

Tourism

-

Urgent repairs ordered after water leak damages Isfahan’s UNESCO-listed mosque

TEHRAN – Cultural heritage authorities have launched emergency measures to contain water leakage and ground subsidence at the UNESCO-listed Jameh Mosque of Isfahan after moisture and cracks were detected near its centuries-old Nezam al-Molk dome.

-

Lawmaker criticizes neglect of Khuzestan’s ‘golden triangle’ of tourism

TEHRAN - A senior Iranian lawmaker on Thursday criticized what he called the neglect of Khuzestan province’s key tourism assets, saying inadequate funding has prevented development of the historical cities of Dezful, Susa and Shushtar.

-

Tabriz can be starting point for tourism cooperation between Iran, Turkey, consultant says

TEHRAN—Orhan Baki, the consultant of the Turkish tourism, commerce and trade company Sulduz considered Tabriz, the capital city of Iran’s East Azarbaijan province, one of the effective destinations for starting joint tourism cooperation between the two countries.

International

-

Israel’s admission of Gaza death toll shatters its own denial

TEHRAN — A quiet admission from a senior Israeli military official has opened a door Israel has tried to keep shut for two years. By acknowledging that around 71,000 people have been killed in Gaza, the official effectively confirmed what the Gaza Health Ministry has been reporting since the start of the war.

-

Trump’s threats against Iraq could backfire

TEHRAN – The U.S. president’s aggressive rhetoric about Iraq’s political future may ultimately produce the opposite of its intended effect.

-

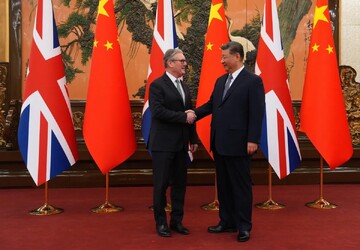

China leads the agenda: Xi–Starmer talks highlight the limits of US unilateralism

TEHRAN — British Prime Minister Keir Starmer’s visit to China has highlighted a broader shift in global diplomacy, showcasing the contrast between nations willing to engage Beijing and the unilateral approach pursued by US President Donald Trump.

Most Viewed

-

‘Iran as ready for diplomacy as it is for war’

-

U.S. seeks an Iran that is subservient, says Chinese expert

-

Iran Army bolsters combat power with massive drone integration

-

Trump’s threats against Iraq could backfire

-

US officials' disagreement over military attack on Iran

-

Iran’s response to any aggression will be ‘immediate, decisive:’ Pezeshkian warns

-

Tehran warns Berlin of consequences following Merz’s ‘low-minded provocations’

-

Iran to EU: IRGC is world’s premier anti-terror vanguard

-

Israel’s admission of Gaza death toll shatters its own denial

-

New Iranian vessel to be unveiled in Caspian Sea, co-op with Russia planned in 200 petchem projects

-

Iran’s non-oil trade tops $94b in 10 months

-

What was used by terrorists to kill innocent people?

-

Iran defeat Saudi Arabia in 2026 AFC Futsal Asian Cup

-

Qalibaf says Iran will pursue justice for terror riot victims at home and abroad

-

A Familiar Signature