-

2026-02-02 22:23

2026-02-02 22:23

By Faramarz Kouhpayeh

Killing with sanctions, lying with statistics

Iran releases names of 3000 killed in January unrest after days of fabricated and politically motivated reporting by Western media

TEHRAN – On Sunday, Iran took the step of publishing the names and national ID numbers of nearly 3,000 individuals killed during the unrest that swept through the country between January 8 and January 14. According to officials, this move was a direct response to weeks of politically motivated reporting and fabrication by Western media outlets.

-

By Fatemeh Kavand

‘American rescue’: A mask of compassion, a face of plunder

TEHRAN - While the Trump administration is officially considering regime-change options in Cuba, reviewing the experiences of countries previously targeted for “American rescue” shows that this concept is not about the welfare of nations—it is a cover for blockade, pressure, and systematic plunder. This pattern also explains Washington’s hostility toward Iran.

-

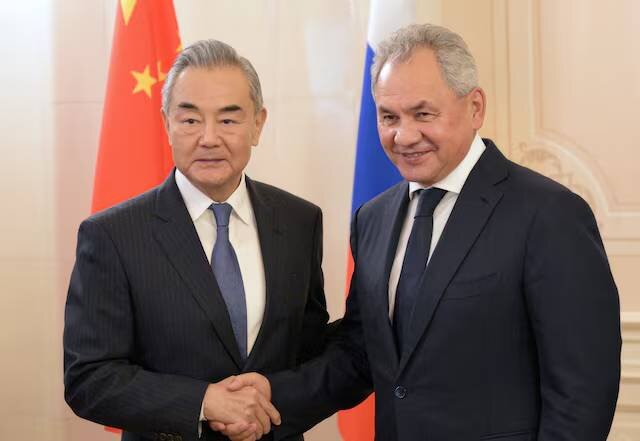

AI-generated fake accounts linked to Israel wage digital war on Iran: Le Figaro

TEHRAN – French newspaper Le Figaro has reported that researchers and disinformation specialists have observed an increase in coordinated campaigns targeting the Iranian public.

-

Pompeo boasts of ‘lots of help’ provided to Iran’s deadly riots

TEHRAN — Mike Pompeo, the former U.S. Secretary of State and CIA director, has provided a rare public admission that Washington orchestrated the recent wave of deadly unrest and terror attacks across the Islamic Republic.

-

Iran poised for nuclear talks resumption with US, reports say

TEHRAN — Negotiating teams from the Islamic Republic of Iran and the United States are reportedly poised to resume high-level discussions in the coming days, with diplomatic momentum building toward a potential meeting in Istanbul as early as Friday.

-

Foreign ministry repeats warning that any attack on Iran would trigger massive war

TEHRAN – Iran warned on Monday that any military aggression against the country would have sweeping consequences for the entire West Asia region, as regional states intensify diplomatic efforts to prevent escalation amid a growing U.S. military presence and contradictory signals from Washington.

Politics

-

Iranians won’t succumb to psychological warfare: 2600 Iranian psychologists tell US

TEHRAN - Some 2600 psychologists and advisors from various Iranian universities have signed a statement in reaction to Washington’s repeated military threats against Iran and efforts to inject psychological instability into the Iranian society.

-

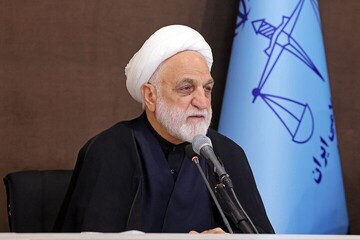

Instigators of insecurity and terrorists will face justice: Iranian top judge

TEHRAN - The Iranian Judiciary chief says the judicial system will firmly deal with those instigating insecurity and conducting acts of terror and treason.

-

‘Iran ready to respond to any mischief by enemy’

TEHRAN - An Iranian parliamentarian has quoted a senior military commander as saying the Islamic Republic is prepared to respond to any mischievous move by the enemy.

Sports

-

Iran’s relentless march toward another Asian futsal crown

TEHRAN - Iran’s national futsal team once again find themselves exactly where they expect to be: deep in the business end of the AFC Futsal Asian Cup.

-

Female sprinter Fasihi wins gold at Budapest event

TEHRAN – Farzaneh Fasihi of Iran won a gold medal at the Budapest Régió Fedettpályás Bajnokság.

-

Iran see off Uzbekistan in AFC Futsal Asian Cup 2026 QFs

TEHRAN - Iran came from two goals down to defeat Uzbekistan 7-4 in a thrilling AFC Futsal Asian Cup Indonesia 2026 quarter-final on Tuesday.

Culture

-

“Field of Color and Struggle” art exhibition opens in Tehran

TEHRAN- A selection of graphic design and illustration works themed around American arrogance is currently on display at Tehran’s Art Bureau, in an exhibition titled “Field of Color and Struggle.”

-

Fajr Theater Festival wraps up at Tehran’s Vahdat Hall

TEHRAN- The closing ceremony of the 44th Fajr Theater Festival was held on Sunday night at Tehran’s Vahdat Hall with honoring the winners in different sections.

-

“Politics of Piety” published in Persian

TEHRAN – The Persian translation of the book “Politics of Piety: The Islamic Revival and the Feminist Subject” written by the Pakistani-American author Saba Mahmood has been released in the Iranian book market.

Economy

-

Nearly 3,300 agriculture projects to be inaugurated during Ten-Day Dawn

TEHRAN – Iran will inaugurate 3,294 agriculture projects across multiple subsectors during the Ten-Day Dawn anniversary period, a senior official at the Agriculture Ministry said.

-

More than $40m in preferential loans allocated to upgrade rail fleet

TEHRAN – The Islamic Republic of Iran Railways (RAI) has allocated 20 trillion rials (over $40 million) in preferential loans to support private-sector investment in renewing the country’s rail fleet, a senior official at the company said.

-

Free zones launch, break ground on 221 projects during Ten-Day Dawn

TEHRAN – Secretary of Iranian Free Zones High Council said 221 development and investment projects worth a combined 690 trillion rials (about $1.38 billion) were inaugurated or launched across the country’s free zones during the Ten-Day Dawn, marking victory of the Islamic Revolution.

Society

-

DOE holds conference on Intl. Wetlands Day

TEHRAN – The Department of Environment (DOE) organized a conference in Tehran on Monday to mark International Wetlands Day, with representatives from the United Nations Development Program (UNDP) and the embassies of the UAE, Iraq, Tajikistan, and Uzbekistan in attendance.

-

National youth week being marked

TEHRAN – The national youth week is being held from January 31 to February 6 across the country with the theme of ‘young Iran, towards a healthier life’.

-

IRCS provides relief services to over 850 people in three days

TEHRAN – The Iranian Red Crescent Society (IRCS) provided rescue services to 853 individuals over the past few days.

Tourism

-

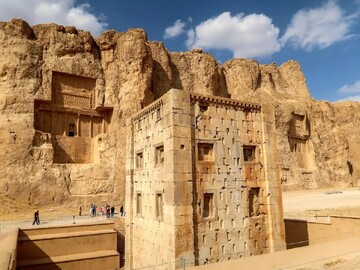

Work on Xerxes I tomb at Naqsh-e Rostam nears completion

TEHRAN – Restoration work on the rock-cut tomb of Achaemenid king Xerxes I is nearing completion after years of conservation efforts, a local official has said.

-

Iran tourism maintains international appeal, expert says

TEHRAN – Iran’s tourism industry continues to attract international interest, an expert said, following the country’s participation in the FITUR international tourism fair in Madrid last week.

-

Study restarts on herbal plant use among nomads of Alborz range

TEHRAN--Field studies of the project of ethnology of herbal plants of Sangsari tribe began in their winter quarter near Div Asiab spring located in the Lar Plain of Mazandaran province.

International

-

Israel’s multi-front war on Lebanese lives, health, and economic survival

BEIRUT — Lebanon has been moving through one of its most sensitive moments in recent months, where military diplomacy, Israeli escalation, and internal fragility intersect dangerously.

-

Iraq must shield itself against U.S. plots

TEHRAN – Iraq must either reflect on political mistakes and failed policies of the past, or shape its future based on the country’s strongest interests.

-

The new exodus of Israelis: Decolonizing Palestine beyond territory

GOA — Zionism required the creation of what its founders called the “New Jew” - a radical reengineering of Jewish identity severed from centuries of ethical, diasporic, and humanist traditions. Judaism, historically shaped by moral restraint, community life, and learning, was recast into a nationalist and militarized project. In this transformation, Jewish ethics were subordinated to the imperatives of conquest, settlement, and permanent war.

Most Viewed

-

A warning to America, resistance forces placed on alert

-

Killing with sanctions, lying with statistics

-

Iran FM eyes short-term nuclear deal while warning of regional wildfire

-

Women as currency: Epstein files and the moral fraud of the Western order

-

The high-stakes of a US strike on Iran and a hard-hitting retaliation

-

Iran poised for nuclear talks resumption with US, reports say

-

IRGC: Certain European countries have become main hubs for nurturing terrorism

-

AI-generated fake accounts linked to Israel wage digital war on Iran: Le Figaro

-

Escalation with Iran is not a linear process

-

Pompeo boasts of ‘lots of help’ provided to Iran’s deadly riots

-

IRGC Navy chief denounces toxic propaganda and hybrid warfare against Iran

-

Egypt, Azerbaijan say ready to help ease tensions in region

-

Govt. publishes data of 2,986 Iranians lost in January unrest

-

Iran’s military chief warns of blitzkrieg offensive against US

-

Foreign ministry repeats warning that any attack on Iran would trigger massive war