-

2026-02-06 20:37

2026-02-06 20:37

By Mona Hojat Ansari

A 'good' restart for Iran-US talks, but path ahead remains unclear

Deep mistrust of Washington persists as both sides return home for consultations

TEHRAN – Iran and the United States held discussions on Friday in Muscat over Iran’s nuclear program and the possibility of a new agreement that would curb certain nuclear activities in exchange for the termination of sanctions. The talks were mediated by Oman’s foreign minister, Badr Albusaidi, who acted as a go-between for the two sides.

-

Trump cannot risk war with Iran, John Helmer says

Veteran journalist warns that a prolonged conflict would trigger inflation, casualties, and a political crisis in Washington

TEHRAN — As tensions persist between Iran and the United States amid intensified military signaling and renewed talk of negotiations, critical questions remain about Washington’s real strategy and the risk of a broader regional conflict. In this context, Tehran Times spoke with John Helmer, a veteran journalist and geopolitical analyst based in Moscow, to examine the shifting balance of power and the prospects for de-escalation.

-

Iran strengthens offensive posture with Khorramshahr-4 missile

TEHRAN — The Islamic Revolution Guards Corps (IRGC) Aerospace Force has inaugurated a massive new underground missile city, marking the operational induction of the Khorramshahr-4 ballistic missile.

-

By Xavier Villar

Iran’s strategy under pressure: Deterrence and diplomacy

MADRID – The latest American military build-up in the Persian Gulf was intended to deliver a familiar message: Overwhelming force was presented as a prelude to political submission.

-

Azerbaijan ‘will not allow any threat’ against Iran from its territory, Aliyev vows

TEHRAN — Azerbaijani President Ilham Aliyev has issued a security guarantee to the Islamic Republic, asserting that Baku will never permit its land to be used for hostile actions against its neighbor.

-

China reaffirms backing for Iran’s sovereignty, security, and legitimate rights

TEHRAN - China has reiterated its support for Iran’s entitlement to safeguard its sovereignty, security, and national dignity as well as its legitimate rights and interests.

Politics

-

‘Criminal Trump and Netanyahu seeking to drag Iran into chaos,’ says sociologist

TEHRAN - A senior sociologist and political analyst says U.S. President Donald Trump and Israeli Prime Minister Benjamin Netanyahu seek to foment turmoil in Iran.

-

Two vessels smuggling fuel are seized in the Persian Gulf

TEHRAN - The naval forces of Iran’s Islamic Revolution Guards Corps (IRGC) have seized two vessels carrying smuggled fuel off Farsi Island in the Persian Gulf waters.

-

Iran has strengthened deterrence by upgrading its ballistic missiles: military chief

TEHRAN - Visiting an IRGC missile town on Wednesday, Chief of the Staff of the Iranian Armed Forces said the Islamic Republic has strengthened its deterrence power by upgrading its ballistic missiles.

Sports

-

Fajr Sepasi defeat Tractor: 2025/26 PGPL

TEHRAN – Fajr Sepasi secured a 2–1 victory over Tractor in Matchweek 20 of the 2025/26 Iran Persian Gulf Professional League (PGPL) on Friday.

-

Iran’s flag-bearers announced for 2026 Winter Olympics

TEHRAN - Samaneh Beyrami Baher and Danial Saveh Shemshaki will carry Iran’s flag into the 2026 Winter Olympic Games, a quiet but powerful moment for a nation rarely seen on snow-covered podiums.

-

Hassan Yazdani wins silver at Zagreb Open 2026

TEHRAN – Iranian freestyle wrestler Hassan Yazdani won a silver medal at the Zagreb Open 2026 on Thursday.

Culture

-

Iranian documentary "The Leather Notebook" unveils Trump-Epstein connection

TEHRAN- Iranian filmmaker Mojtaba Minavand has recently made a documentary on the intricate web of connections surrounding Jeffrey Epstein and his alleged clientele, including U.S. President Donald Trump.

-

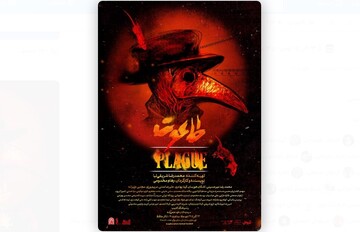

Loose adaptation of Albert Camus’ “The Plague” on stage in Tehran

TEHRAN- A loose adaptation of French philosopher and novelist Albert Camus’ novel “The Plague” is currently on stage at Hafez Theater Hall in Tehran.

-

“Ashoon” audiobook released

TEHRAN_The audio version of the book “Ashoon” written by the Iranian author Tahereh Rafat has been released on the Persian audiobook platforms.

Economy

-

South Pars gas output sets 9 production records over past 2 years

TEHRAN – Iran’s South Pars gas field has set nine production records over the past two years, with daily output reaching a new high of 727 million cubic meters, underscoring the field’s central role in meeting the country’s energy demand.

-

China backs east–west corridor through Iran, economy minister says

TEHRAN – Iran’s economy minister said China has strongly backed routing an east–west transport corridor through Iran, following talks with Chinese President Xi Jinping during a recent visit to Beijing.

-

Oil product transfers from Persian Gulf region rise 13%

TEHRAN – Iran’s Persian Gulf oil pipelines region recorded a 13 percent rise in oil product transfers in the first 10 months of the current Iranian calendar year (late March, 2025-late January, 2026) compared with the same period last year, the regional director said.

Society

-

Plan to launch IRCS medical center in Yerevan in final stage

TEHRAN – The head of the Iranian Red Crescent Society (IRCS), Pirhossein Kolivand, and the president of the Armenian Red Cross Society (ARCS), Davit Nersisyan, have conferred about the final stage of a project to establish a medical center in Yerevan.

-

Iran, Uzbekistan extend deadline for joint scientific research submission

TEHRAN – Iran National Science Foundation (INSF) and the Agency for Innovative Development under the Ministry of Higher Education, Science, and Innovation of the Republic of Uzbekistan have extended the deadline for the submission of joint scientific research.

-

Second round of polio vaccination to kick off by mid-February

TEHRAN – The supplementary phase of the national immunization campaign for polio eradication, using domestically produced vaccines, will be carried out from February 14 to 16, targeting some 700,000 children under the age of five.

Tourism

-

Iran tourism has potential to rebound quickly, guides’ head says

TEHRAN – Iran’s tourism industry has the capacity to recover quickly if security, stability and policy coordination are strengthened, the head of the Iranian Tourist Guides Association said on Thursday.

-

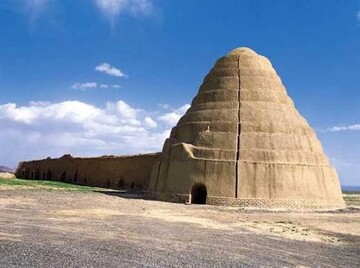

Before refrigerators, Iran had Yakhchals: Where did summer ice come from?

GONABAD – Have you ever paused, while sipping a chilled sharbat or juice with ice cubes floating inside, or enjoying an iced tea or iced coffee, to wonder how people kept their drinks and food cool before modern refrigerators and ice makers existed? Did they have access to cold water during the scorching days of summer? To find the answers, one can look to the heart of Iran’s desert cities—places where architectural ingenuity and human adaptation to nature gave rise to remarkable structures known as yakhchals, or icehouses.

-

Iran highlights on view at EMITT 2026

TEHRAN – Iran has taken part in the 29th edition of the EMITT 2026 International Tourism Exhibition, which opened on Thursday in Istanbul, Turkey.

International

-

Olmert’s belated confession: When ‘ethnic cleansing’ enters Israel’s political vocabulary

TEHRAN – Ehud Olmert’s recent article describing a “violent and criminal attempt at ethnic cleansing” in the occupied West Bank reads less like a revelation than a confession delivered far too late. What makes his words notable is not that they uncover a hidden reality, but that they strip away the last remnants of plausible deniability from within Israel’s own political establishment. Palestinians, human rights organizations, and international observers have documented these crimes for decades. Olmert’s intervention matters only because it confirms that those at the very center of Israeli power have long known exactly what was happening.

-

Rafah crossing: Symbolic gesture or start of a new era?

TEHRAN – After two years of closure, the Rafah land crossing has once again come into the spotlight.

-

When survival becomes a target: Lebanon faces U.S.–backed Israeli aggression

BEIRUT— As tensions continue to rise across West Asia, Lebanon’s political scene is increasingly shaped not by its internal files, but by the shadow of a wider regional confrontation.

Most Viewed

-

Trump cannot risk war with Iran, John Helmer says

-

Iran has strengthened deterrence by upgrading its ballistic missiles: military chief

-

Iran calls Merz naive, hopes a ‘mature’ person would take over leadership in Germany

-

Iran strengthens offensive posture with Khorramshahr-4 missile

-

Iran and US are holding nuclear talks in Oman

-

A 'good' restart for Iran-US talks, but path ahead remains unclear

-

Iran’s flag-bearers announced for 2026 Winter Olympics

-

Iranian documentary "The Leather Notebook" unveils Trump-Epstein connection

-

War on Iran could blow up entire region, Lavrov warns

-

Iran into 2026 AFC Futsal Asian Cup final

-

China reaffirms backing for Iran’s sovereignty, security, and legitimate rights

-

China backs east–west corridor through Iran, economy minister says

-

Azerbaijan ‘will not allow any threat’ against Iran from its territory, Aliyev vows

-

Possible remains of monumental Persian garden identified near Tabriz

-

Vice-presidency for science details supports for space industry development