-

2025-07-14 21:51

2025-07-14 21:51

By Soheila Zarfam

Bibi hangs onto ‘daddy’ over missile nightmare

PM says Iran’s missile range should be limited to 480 km after large destruction in Israel

TEHRAN – Benjamin Netanyahu's five-day trip to the United States was marked by a series of eyebrow-raising pronouncements. From announcing that he will nominate Donald Trump for a Nobel Peace Prize to claiming he wants a “better future” for Palestinians after killing over 60,000 of them in cold blood, the Israeli Prime Minister delivered the kind of outlandish statements observers have now come to expect.

-

Pezeshkian visits families displaced by Israeli attacks, vows continued support

TEHRAN — Iranian President Masoud Pezeshkian met on Monday with several families affected by the recent Israeli aggression during a visit to a temporary shelter center in Tehran Province.

-

New figure says 1,062 martyred, 5,800 wounded in 12 days of Israeli aggression

TEHRAN – Head of Iran’s Martyrs and Veterans Affairs Foundation, Saeed Ohadi, confirmed on Monday that at least 1,062 people were killed during Israel’s 12-day military aggression against Iran, with 5,800 others wounded.

-

European snapback bid would be ‘utter audacity,’ senior Iranian diplomat warns

TEHRAN – Iran’s Deputy Foreign Minister for Legal and International Affairs, Kazem Gharibabadi, condemned potential European efforts to trigger the snapback mechanism as an act of "utter audacity," warning that it would significantly curb talks with European counterparts and provoke proportional countermeasures.

-

By Dr. Jin Liangxiang

A nation grows stronger in adversities

SHANGHAI - The last June witnessed one of the most flagrant aggressions against a sovereign nation state in its modern history and one of the largest military clashes in recent human history. National characters are always manifested in big events, and the following three, together with others, are particularly demonstrated in the 12-day war. A nation facing challenges, difficulties, and adversities could grow even stronger.

-

By Sahar Dadjoo

Suicides among Israeli soldiers expose systemic breakdown

TEHRAN - Since the outbreak of the Gaza war in October 2023, the Israeli military has been grappling with a surge in suicides among soldiers.

Politics

-

War not our choice, but surrender not an option: Pezeshkian to Iranian diaspora

TEHRAN – Iranian President Masoud Pezeshkian has reaffirmed Iran’s commitment to diplomacy and national sovereignty in a message to Iranians living abroad following the 12-day war with the Israeli regime.

-

Netanyahu failed to win war, now trying to control U.S. policy on Iran: Araghchi

TEHRAN — Iranian Foreign Minister Abbas Araghchi has said Israeli Prime Minister Benjamin Netanyahu failed to achieve any of his objectives in the regime’s recent war against Iran, yet is now attempting to dictate U.S. policy on Iran’s missile and nuclear programs.

-

Iran, Iraq, Pakistan unite for Arbaeen amid regional solidarity against Israeli aggression

TEHRAN – The interior ministers of Iran, Iraq, and Pakistan convened in Tehran on Monday for a trilateral summit focused on coordinating security and logistical measures for the upcoming Arbaeen pilgrimage.

Sports

-

Negin Rasoulipour wants to rewrite history

TEHRAN - For Negin Rasoulipour Khameneh, the FIBA Women’s Asia Cup 2025 is more than just another tournament. It is a chance to rewrite history.

-

Iran earn third win in 2025 Asian U16 Volleyball Championship

TEHRAN – Iran defeated Kazakhstan in straight sets (25-11, 25-16, 25-21) in the Asian Men’s U16 Volleyball Championship Thailand 2025 on Monday.

-

Katic named Sepahan goalkeeping coach

TEHRAN – Branko Katic has been named as goalkeeping coach of Sepahan football club.

Culture

-

Ashura opera puppet show returns to stage to commemorate Muharram

TEHRAN – Iranian director Behruz Gharibpour is restaging the Ashura opera puppet show with his Aran Theater Troupe at Tehran’s Ferdowsi Hall to mark the month of Muharram.

-

“The Toilers of the Sea” comes to Iranian bookstores

TEHRAN – “The Toilers of the Sea” by French writer Victor Hugo has been published in Persian by Hermes Publications.

-

IAF to review “The Phoenician Scheme”

TEHRAN – The Cinematheque of the Iranian Artists Forum (IAF) will screen American filmmaker Wes Anderson’s 2025 movie “The Phoenician Scheme” on Thursday.

Economy

-

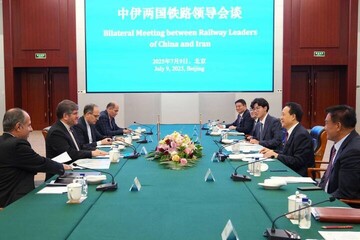

Iran an important partner in One Belt, One Road initiative: China Railway general manager

TEHRAN- The general manager of China State Railway Group Company, known as China Railway (CR), considered Iran an important partner in the "One Belt, One Road" initiative and emphasized the need for coordination to stabilize prices and facilitate customs processes in the Southern Corridor.

-

Solar power plants with capacity of 11.5 MW put into operation in Khorasan Razavi

TEHRAN- Solar power plants with the capacity of 11.5 megawatts (MW) were put into operation in Khorasan Razavi province, in the northeast of Iran, on Monday morning.

-

Annual copper cathode production increases 1.7%

TEHRAN- Production of copper cathode in Iran increased by 1.7 percent in the past Iranian calendar year 1403 (ended on March 20), Tasnim news agency reported.

Society

-

Over 27,000 people donated blood on Tasua, Ashura

TEHRAN – A total of 27,200 Iranians donated blood under a national campaign during Tasua and Ashura (the ninth and tenth days of the month of Muharram), according to Bashir Haji-Beigi, spokesman for the Blood Transfusion Organization.

-

Iranian students rank 2nd in Intl. Mathematics Summer Camp

TEHRAN – An Iranian team comprising six students placed second in the 3rd International Mathematics Summer Camp (IMSC) held in Beijing, China, from June 20 to July 12, 2025.

-

Ad hoc working group to deal with sand and dust storms

TEHRAN – President Masoud Pezeshkian has issued an order calling for the establishment of a specialized working group to address sand and dust storms (SDSs), which have turned into a significant public health concern in the country.

Tourism

-

‘I will never regret coming’: solo female traveler reflects amid Israel’s strikes on Iran

TEHRAN - When 24-year-old Taiwanese traveler Ariel Kang Chengxuan went to bed on June 12 in Isfahan, Iran, she had no idea she was about to wake up in the midst of all-out war.

-

University of Michigan professor congratulates Iran on UNESCO designation of Paleolithic caves

TEHRAN - Professor John D. Speth, a distinguished anthropologist and emeritus faculty member at the University of Michigan, has warmly congratulated the recent inscription of the Paleolithic caves of Iran’s Khorramabad Valley on the UNESCO World Heritage List.

-

224 Hamedani Mookebs render services to Arbaeen pilgrims

TEHRAN—Reza Mousavi, a senior official of Hamedan province, said 224 Mookebs (service centers with a religious nature where Shia Muslims come together and conduct religious rituals during Arbaeen) have been launched across the province to render services to the pilgrims during Arbaeen.

International

-

A nation grows stronger in adversities

SHANGHAI - The last June witnessed one of the most flagrant aggressions against a sovereign nation state in its modern history and one of the largest military clashes in recent human history. National characters are always manifested in big events, and the following three, together with others, are particularly demonstrated in the 12-day war. A nation facing challenges, difficulties, and adversities could grow even stronger.

-

Suicides among Israeli soldiers expose systemic breakdown

TEHRAN - Since the outbreak of the Gaza war in October 2023, the Israeli military has been grappling with a surge in suicides among soldiers.

-

Geagea Justifies US Envoy’s Threats on Annexing Lebanon to Syria

BEIRUT — Despite sparking widespread public and political outrage, Lebanese Forces leader Samir Geagea was quick to justify the threats made by the US envoy to Lebanon, Thomas Barrack, regarding Lebanon’s “concession” to Syria and its inclusion as part of the Levant.

Most Viewed

-

'I gave up my son, will give up my wealth too. Build missiles to hit the heart of Tel Aviv'

-

Will European TNT demolish NPT?

-

Tel Aviv struggles to counter Ansarallah strikes amid growing military failures

-

Merz’s Iran remarks reminiscent of Nazi mentality

-

Why does Jolani threaten Lebanon over his henchmen?

-

Iran, the US base at Al Udeid, and the logic of calibrated deterrence

-

Dramatic US threat to Lebanon: Surrender by force or else!

-

Inside Israel’s botched attack on Iran's Supreme National Security Council

-

Iran’s envoy to Russia: Tehran’s nuclear rights non-negotiable

-

‘Ice has broken’ in Iran-Egypt relations, says outgoing Iranian diplomat

-

Snapback will end Europe’s engagement on Iran’s nuclear program, FM warns

-

New ambushes hit occupation regime’s military

-

Global Gold at the Crossroads of Crisis

-

28 ambassadors to Iran tour attacked IRIB complex

-

Another Iranian-American arrested as US intensifies crackdown on Iranian diaspora