Americans anxiously await debt ceiling deadline

TEHRAN- A U.S. default on its debt is looming and failure to reach a deal will have far-reaching consequences.

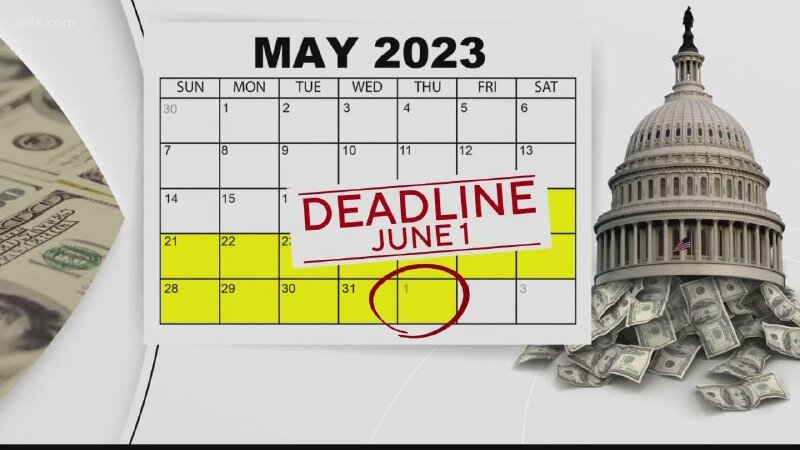

The administration of U.S. President Joe Biden has less than a week to strike a deal with Republicans, otherwise it will run out of money to pay millions of workers including American soldiers, but the ripple effects will be felt across the world and in particular Washington's Western allies.

The current cap on the U.S. federal debt is $31.4 trillion dollars. That's how much the world's strongest economy has borrowed this year to pay off its bills.

The White House and the Republican controlled House of Representatives are stalling on talks to reach an agreement to raise the amount of money the U.S. can borrow.

The main bone of contention being argued in public between the two sides is that Biden wants to increase the amount of money Washington can borrow, while Republican House Speaker Kevin McCarthy wants to see some spending cuts first before raising the debt ceiling.

Caught in the middle are millions of Americans including federal employees, the military, those who rely on welfare benefits and medical patients on Medicare, as well as stock markets tied to Wall Street, all of whom are already on edge. Another fresh wave of selling hit European stock markets on Wednesday.

The Treasury Secretary Janet Yellen has warned that if the Biden Administration can not borrow more funds as of the end of May, the U.S. will not have enough money to meet its financial obligations.

In reality, the talks between the two sides have been stalled for political purposes so that Republicans can bring the Biden administration along with the Democrats down ahead of the 2024 presidential election.

At the G7 summit in Hiroshima, Biden admitted the devastating consequences for his re-election bid if the U.S. is unable to pay its bills, saying “because I am president, and presidents are responsible for everything, Biden would take the blame. And that’s one way to make sure Biden is not re-elected.”

If an agreement is not reached to raise the debt ceiling, the U.S. administration will default on its debts and the U.S. will enter uncharted territory as this is usually a formality to pass a higher debt cap in Congress and not raising the annual level of money the U.S can borrow will be the first time such a scenario has played out in the country

The current state of affairs is a strong indication of just how polarized U.S. Democrats and Republicans have become, that Washington has allowed this to drag on and potentially have a catastrophic knock on affect for Americans and cause major economic damage.

In the short-term, Moody's Analytics has forecast that if no deal is made by June 1, stock prices will fall by almost a fifth, the U.S economy would contract into a recession, mass layoffs will be seen with at least seven million Americans out of work, while reports say 15 million U.S. army veterans and their families will be harmed.

U.S. Defense Secretary Lloyd Austin has warned that a default would see “a substantial risk to our reputation with allies and security partners across the globe" who would questions “as to whether or not we will be able to execute (military) programs.”

There is a slow but certainly growing pattern in the West, where the executive branch bypasses parliament and takes matters into its own hands. This was seen in France where President Emmanuel Macron bypassed Parliament to raise the pension age despite nationwide protests and strikes by millions of French people against the deeply controversial move. Biden may declare a national emergency and raise the debt ceiling by himself.

Another major knock-on effect would be on the U.S. dollar as a global reserve currency that is slowly becoming a non-global currency. American allies have been using the U.S. dollar to settle trade transactions, which eases America settling its own bills.

The current demand for U.S. dollars absorbs America's trade and budget deficits as foreign central banks are willing to hold their surpluss dollars in the form of U.S. treasury bonds. This has been overlooked by Congress since the Second World War as the U.S. can just print dollars as foreign central banks use them.

But the dollar is losing its role as global reserve currency: a direct result of Washington's policies of sanctions and unilateralism over the past two decades, which has in turn convinced other countries that its actually quite risky to use American dollars or hold on to them because they could one day be subject to sanctions by the U.S. themselves.

Many regions in the world have seen how the U.S. can turn on countries that it once considered as allies.

The world is witnessing a rising number of nations settling their trade transactions in currencies, mostly local currencies, but not the U.S. dollar.

This is now posing a threat to the U.S. being able to settle its debts as Washington has been for a long time seeing the rest of the world, in essence, financing its own debt with the U.S. dollar.

The swift system is used for trade transactions via mostly the U.S. dollar and, to a lesser extent, other Western currencies who have also joined the U.S. led sanctions regime against adversaries, such as Great Britain and Canada. International trading systems such as swift is now facing a challenge from many governments and global organizations such as BRICS, the five regional economies of Brazil, Russia, India, China, and South Africa.

As the U.S. seeks to raise the annual debt ceiling, it could find itself in quite a difficult place where it has to pay back back its debt (in its entirety) on its own.

In other words, the U.S. Congress could soon find itself having to lower the amount of money it borrows every year and not increase the debt ceiling.

Where that money will come from is up for debate. But it would be forced to come out of other budgets, and one of those is the $857.9 billion U.S. military budget that was passed for the fiscal year 2023.

The U.S. military has been rising every year, and, as the pattern over the past decade shows, is set to hit one trillion dollars very soon. Cutting back on the "defense" budget would see a major setback for America's military adventurism abroad.

The U.S. military expenditure is much higher when other aspects are taken into account, for example, the more than $2.3 trillion it spent on the war and occupation of Afghanistan (and that was just one country the U.S. has invaded or militarily interfered in) or its nuclear weapons program.

The U.S. War economy comes at a time when Americans are suffering back at home from the dismal infrastructure, agriculture, medical care, suicide rates among teenagers and army veterans, mass shootings, etc, which the authorities have failed to address.

In the middle of this current crisis, where the politicians are speaking about how much money is needed to increase the debt ceiling, there is always money available for war.

And so the U.S., through its aggressive and unilateral foreign policies, has essentially shot itself in the foot.

Leave a Comment