China: Afghanistan’s top investor

West’s failure opens doors for East

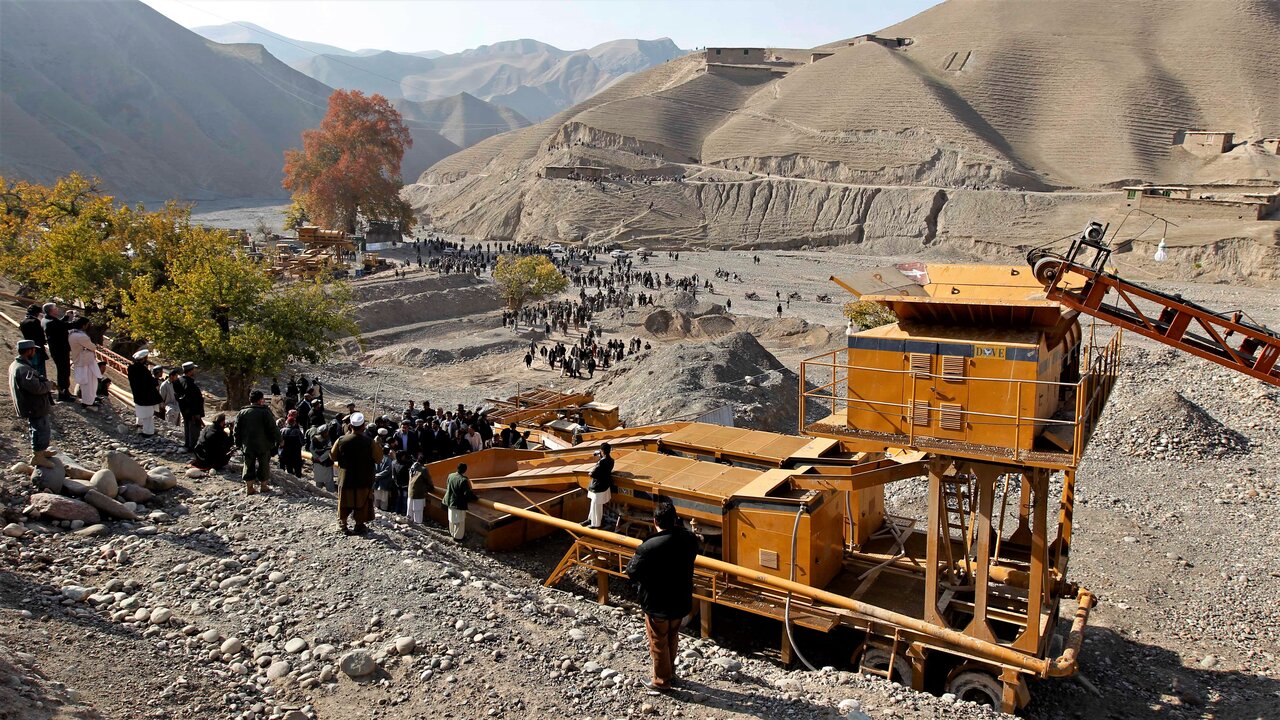

TEHRAN -- Years of wars, occupation, and anarchy have left Afghanistan’s natural resources unexploited due to a lack of investment and the transfer of technology. According to the U.S. and UN assessments, minerals buried across Afghanistan’s rocky landscape are estimated to be worth a trillion dollars.

Today, emeralds, rubies, marble, gold, lithium, and other mineral resources remain unexploited. “We have no exports, no infrastructure, no knowledge”, said Homayoun Afghan, the spokesman of the Ministry of Mines.

The Taliban fought a two-decade insurgency against the U.S. and NATO-backed Afghan government in Kabul, seizing power in a military campaign in 2021 after foreign forces withdrew.

Pundits say that China has used the void left by the withdrawal of Western foreign troops to become Afghanistan’s number-one foreign direct investment (FDI) partner.

The Taliban first took control of Afghanistan from 1996 to 2001. In the aftermath of the 9/11 terrorist attacks in 2001, they were overthrown by American-backed Western forces. However, the group returned to power following a vacuum left by the 2021 withdrawal of Western troops. The country was named the Islamic Emirate of Afghanistan. So far, no international government has recognized the Taliban as Afghanistan’s legitimate government.

The cash-strapped Afghan government has been eager to exploit the country’s vast and lucrative mineral deposits. Lucrative contracts to tap gold, gemstones, and minerals such as chromite, which is used in steelmaking, have gone to local Afghans as well as investors from China.

Although China has yet to recognize the Taliban-led Afghan government, Beijing has called for economic sanctions on Afghanistan to be lifted and the Taliban given access to nearly $9bn in reserves held in international accounts. Access to the central bank reserves held in U.S. banks was frozen during former President Joe Biden’s administration.

Afghanistan also sits in a region important for China’s Belt and Road Initiative (BRI).

Promoting trade with neighboring Afghanistan is a priority for China. According to media reports, Beijing’s envoy in Kabul Zhao Xing wrote last October on his official X-account: “China will offer Afghanistan zero-tariff treatment for 100% tariff lines.” During the time of tariff wars, which U.S. President Donald Trump started recently, the Chinese envoy’s statement would provide the Taliban government with tariff-free access to Chinese markets, including the construction and energy sectors.

Taliban-led Afghanistan’s first significant foreign investment deal came in January 2023, when the Chinese company Xinjiang Central Asia Petroleum and Gas Co (CAPEIC) signed a contract to extract oil and develop an oil reserve in Afghanistan’s northern province of Sar-e-Pul.

“CAPEIC will invest $150m a year in Afghanistan under the contract,” the spokesperson for the Taliban-run administration, Zabihullah Mujahid, said on Twitter.

Its investment would increase to $540m in three years for the 25-year contract, he said.

The Taliban-run administration will have a 20 percent partnership in the project, which can be increased to 75 percent, Mujahid added.

So far, some 200 mining contracts have been signed between Afghanistan and various Chinese companies, creating some 150,000 jobs in the mining sector since 2021.

Although America is still the world’s largest economy, China overtook US to become the world’s top crude importer in 2015. Afghanistan’s lithium, copper, and iron exports to the world’s largest commodity buyer will help the Taliban bolster its fragile economy with a much-needed revenue stream.

In another development in the mining sector, China-based scmp.com reported that after a 16-year delay, a groundbreaking ceremony was held last summer (July 2024) after the conclusion of talks between state-owned China Metallurgical Co. Ltd. (MCC) with the Taliban government, one of the world’s largest copper mines in Logar Province. Afghanistan is home to the world’s second biggest copper deposit, a crucial input in electric vehicle batteries and semiconductors. A $3 billion deal was signed in 2008, giving the state-owned MCC a 30-year mining concession, but combat between NATO-led troops and Taliban insurgents put a 16-year delay into the project.

Afghanistan has significant crude reserves, and production has been primarily focused in the Amu Darya basin, an area covering 4,500 square kilometers collectively in northern Sar-e Pul, Jawzjan, and Faryab provinces. The amount of oil reserves is estimated to be 87 million barrels. In this case, the first major FDI deal for oil extraction since the Taliban’s takeover was signed in January 2023. The contract was signed between former Minister of Mines and Petroleum Sheikh Shahabuddin Delawar and an official from CAPEIC.

“Over 3,000 people will get jobs in this project,” Al Jazeera news agency quoted Delawar. He added that the condition of the deal was that the oil be processed in Afghanistan.

Turkmenistan and India have also reached out to the Taliban-led Afghanistan for investments in various projects, the Caspian News reported. Last September, Turkmenistan’s Foreign Minister, Rashid Meredow, announced that Ashgabat had invested over $1.5bn in joint projects with Afghanistan. Meredow invited India, Pakistan, international banks, and the Asian Development Bank to invest in the Turkmenistan-Afghanistan-Pakistan-India (TAPI) gas pipeline project. The pipeline will transport gas from Turkmenistan to Pakistan and India, passing through several Afghan provinces.

India has invested more than $3bn in Afghanistan over the past two decades, mainly in infrastructure projects. An example is the construction of Zaranj-Delaram highway in southwestern Afghanistan, which was completed in 2009, linking Afghanistan with Iran’s Chabahar port.

The Iran-Afghanistan bilateral trade reached $3.366bn at the end of the last Iranian year (ending March 21, 2025). Iran has already invested in Afghanistan’s mining sector, particularly in the Ghorian mine in Herat.

On the table is the establishment of a special joint mineral economic zone between the two countries.

CONCLUSION

If the Taliban can kick-start Afghanistan’s mining sector, they will succeed where two decades of Western-backed initiatives had flopped – one more testament to the failures of America’s $2 trillion war in the country.

Leave a Comment