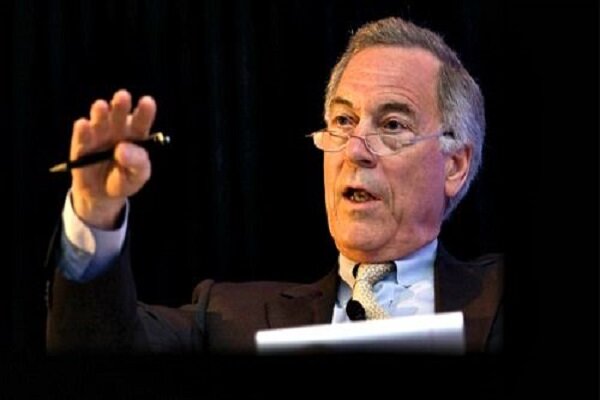

Sanctions have proven ineffective: American economist

TEHRAN – Noting that the sanction is a failed policy, a professor of applied economics at Johns Hopkins University says that the U.S. is totally addicted to sanctions as an “economic weapon of war”.

"The U.S. is totally addicted to sanctions as an economic weapon of war. At present, the U.S. has in place 8,842 sanctions," Steve H. Hanke tells the Tehran Times.

Hanke is one of the American economists that believes sanctions have a long history of not achieving their stated goals.

The professor of Johns Hopkins University is famous for his idea of using gold as anchor currency to contain effects of sanctions, saying, "If Iran adopted a currency board and used gold as its anchor currency, Iran would make the rial as good as gold."

Following is the text of the interview with Steve H. Hanke:

Q: Apparently the U.S. is getting more addicted to sanctions as an economic weapon. It was the case during Trump's presidency when he imposed harsh sanctions on Iran within his "maximum pressure" policy against the Islamic Republic. Also, the U.S. is using sanctions against Russia and Turkey. Do you think the sanction policy has proved successful for Washington?

A: The U.S. is totally addicted to sanctions as an economic weapon of war. At present, the U.S. has in place 8,842 sanctions. I, for one, oppose sanctions as a matter of principle and as a matter of practice. As a starting point and a matter of principle, free trade is, in my view, the correct principle. States should not be engaged in imposing restrictions on trade, whether it be internal trade within a country or external foreign trade. So, as a matter of principle, sanctions are, in general, "bad." As a practical matter, all the scholarly research points to the fact that sanctions rarely achieve their desired objectives. Indeed, they usually involve, among other things, a rally-around-the-flag effect that simply supports and entrenches those who are targeted. In addition, they have a history of spawning vast webs of international, illegal, mafioso, underworld activities. Sanctions are clearly for losers.

Q: What are the main options or tools of countries that are under sanctions pressure? Do you think that barter trade besides close bilateral ties, instead of dependence on global market, can help counter sanctions?

A: The main options and tools for those countries that are sanctioned are to embrace sound monetary policies and policies that completely liberalize and deregulate their economies. All research shows that countries with sound money and greater degrees of economic freedom grow at higher rates than countries with unstable currencies and highly regulated economies. The lesson for Iran is clear: it could mitigate the damage imposed by external sanctions if it would liberalize the economy and adopt sound monetary policies. Indeed, at present, economic freedom in Iran is almost nowhere to be found. In Cato Institute's 2020 Human Freedom Index, Iran ranks 158th out of 162 countries in Economic Freedom. This terrible ranking has absolutely nothing to do with economic sanctions. The heaviest damage being done to the Iranian economy is being done by the government, not by misguided U.S. sanctions.

So, how could Iran guarantee that the rial would be sound? The best option for Iranian economic stability is a currency board. A currency board issues notes and coins convertible on demand into a foreign anchor currency at a fixed rate of exchange. It is required to hold anchor-currency reserves equal to 100% of its monetary liabilities.

A currency board has no discretionary monetary powers and cannot issue credit. It has an exchange-rate policy but no monetary policy. Its sole function is to exchange the domestic currency it issues for an anchor currency at a fixed rate. A currency board's currency is a clone of its anchor currency.

A currency board requires no preconditions and can be installed rapidly. Government finances, state-owned enterprises, and trade need not be reformed before a currency board can issue money. Currency boards have existed in some 70 countries. None have failed. I know, as I've studied all of these systems in detail and was the architect of the newer ones in Estonia (1992), Lithuania (1994), Bulgaria (1997), and Bosnia-Herzegovina (1997).

If Iran adopted a currency board and used gold as its anchor currency, Iran would make the rial as good as gold.

Q: You are critical of using Bitcoin as a legal tender in El Salvador. But it can help countries to avoid American unilateral sanctions. Could you update us about the advantages and disadvantages of using Bitcoin?

Bitcoin's volatility prevents it from being a unit of account, a store of value, a medium of exchange and a standard for deferred payment. Thus, Bitcoin is not a currency, only a highly speculative asset. Bitcoin is a loser's game. I think its fundamental value is zero and I see no advantages. If you want a "currency" that is not issued by a sovereign, the best-proven alternative is gold. Indeed, gold has held its purchasing power for thousands of years.

Q: Many in the U.S. criticize the 25-year partnership between Iran and China. What alternatives can they suggest while the West, under the U.S. unilateral sanctions, failed to have transactions with Iran? Is it fair to portray China as a malicious economic power, while Western countries, including the U.S. and its European allies, have immense trade and economic ties with China?

A: First, any sovereign should be free to engage in any mutually agreed upon bilateral relations that they wish. In the case of the Iran-Chinese 25-year partnership, the stupidity of sanctions is revealed. I think one can make the case that unilateral sanctions against Iran have encouraged Iran to establish bilateral relationships that might be frowned upon by the U.S., the country that imposed the sanctions in the first place. As they say in economics, incentives matter. Indeed, economics is all about incentives, and sanctions have incentivized and cemented the Iran-Chinese 25-year partnership.

Q: Why is "socialism" often perceived as pejorative in American politics? Are there ideological reasons behind such a perception as socialism is not just represented by the Soviet Union? We have successful social democracies in northern Europe. This is also the case to some extent in Canada.

A: I don't agree with your overarching premise that socialism is perceived in a pejorative sense in today's American politics. Although many in America, including myself, have a negative view of socialism, it's being promoted by the Biden administration. Furthermore, I don't agree with your assertion that there have been successful socialist democracies in Europe, and this is the case to some extent when talking about Canada. Socialism is at the antipode of economic freedom. If one measures economic freedom, you find a wide range from countries that possess a great deal of economic freedom like Hong Kong, Singapore, New Zealand, Switzerland, and Australia to those with virtually no economic freedom (read: those that are highly socialistic) such as Iran, Angola, Libya, Sudan, and Venezuela. Indeed, as I showed in an article, "Economic Freedom, Prosperity, and Equality: A Survey," published in the Cato Journal several years ago (1997), the relationship between economic freedom and growth is unambiguous: the countries that possess a higher level of economic freedom and less socialism to grow at a much more rapid rate and are more prosperous than those with more socialistic tendencies. That's one reason why the U.S. consistently grows more rapidly than Western Europe. Indeed, Western Europe has entered a period of stagnation, losing its market share in the global economy and registering productivity growth that's dwindled to almost zero. Thanks to socialistic welfare states, Western Europe has ended up in a low-growth trap.

Leave a Comment